Award-winning PDF software

Mortgage without 4506 t Form: What You Should Know

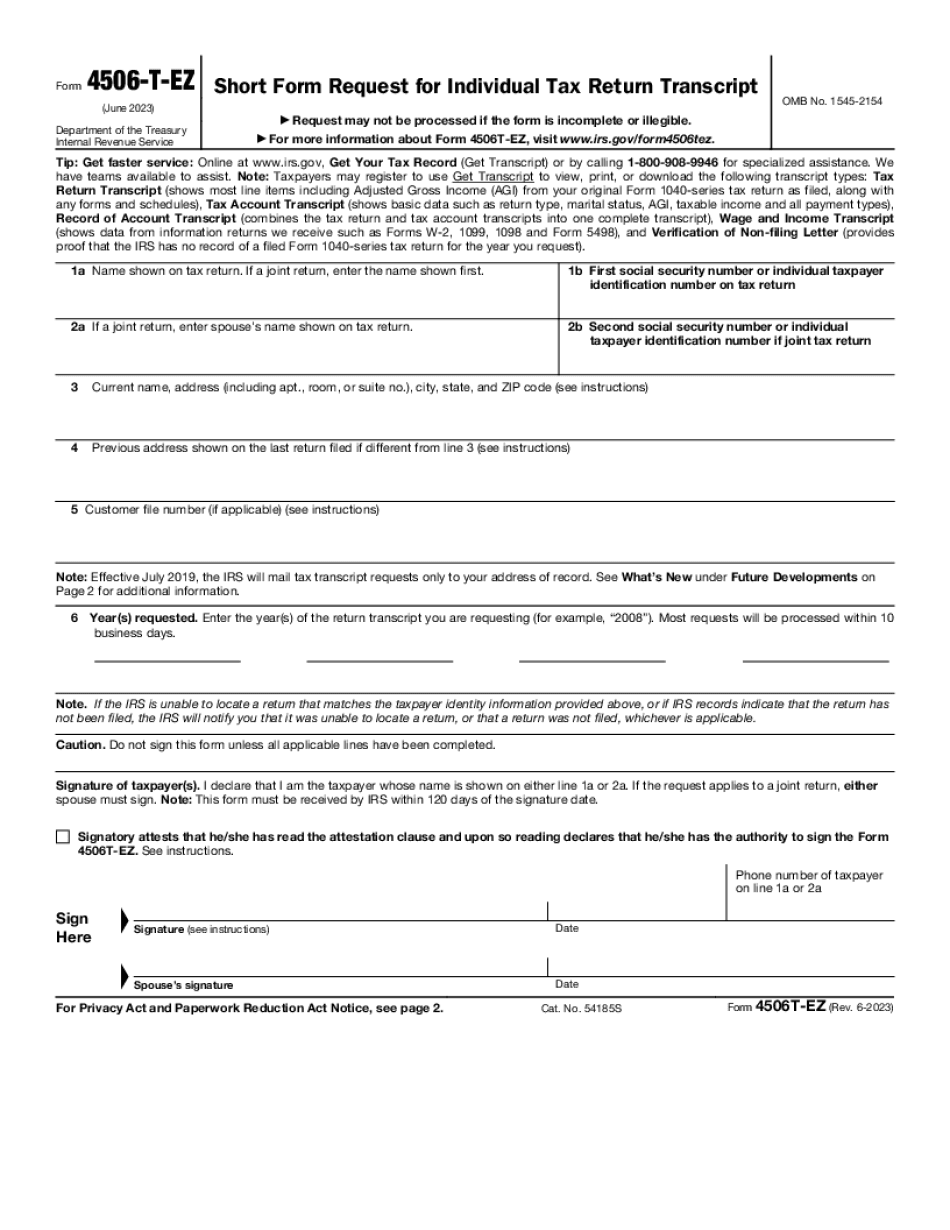

Form 4506 and give the lender a copy of his tax transcript in order for the lender to apply for the loans you lend them. IRS Form 4506 is available at your local IRS office. Tax Return Tax Transcripts on Tax Year 2025 Tax return transcripts are due in the month you file your 2025 tax return. After you receive the 2025 tax return transcript it will be sent from the IRS to your local tax collector in 7-14 days. Once you receive your 2025 tax return transcript you can: View the transcript of your tax return View your 2025 tax transcript Receive tax payment statement Dec 8, 2025 — A tax return transcript is required in order for your lender to apply for a loan. Tax Refunds Taxpayers must submit a tax return transcript to verify their taxable income. If your tax return information is not on your transcript, or does not match your tax records, your lender might not be eligible for a tax refund on the amount you paid to them. Tax Return Transcript Form 4506-T and Forms 1040 Dec 30, 2025 — The IRS requires you to provide a copy of your Form 1040 or 1040A along with the tax return Transcript. Form 4506-T is available online at IRS.gov. The form 4506-T must be completed in duplicate. The PDF file is approximately 4.7 m by, and allows you to upload additional documents to the form. The PDF file must be completed and completed in Microsoft Word and uploaded to their online form download system. You will be able to add attachments to the form. Forms 4506 and 4506A are used for tax return authentication and verification. Tax Return Transcript Example Tax Return Transcript Example — Taxpayers who file their 2025 tax forms on the Federal government's website will be able to do a tax refund online via the IRS website. Form 4506-T and Forms 1040 Oct 22, 2025 — The Tax Cuts and Jobs Act of 2017, signed into law by President Donald J. Trump, made changes to tax forms that were used for tax return verification purposes. Form 4506-T, Form 1040, the federal income tax forms are now only accessible in the following three formats: PDF, Microsoft Word or a TXT file. This change will be implemented in January 2019.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506T-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506T-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506T-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506T-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.