Divide this text into sentences and correct mistakes: 1. What's up hey, this is great! Back men from the Beckman mortgage team here, just giving you a quick update, a quick tip. Trying to do this on a consistent basis for you guys and gals. 2. We have a program called W2 program, okay? So, what does that mean? A lot of times, if somebody is a W-2 employee, sometimes they write off some items for their business. Well, we don't need to see tax returns under this program, which is pretty cool because if you write stuff off, what happens is that it decreases your income for qualifying. Now, you and me, and everybody else knows that hey, you like you do make this money but you write it off for taxes. When it comes to the evil underwriter, what they look at is basically taking that off your income. So, for example, let's say you make $50,000 W2 but you're a teacher and you write off stuff during the summer - odd jobs, travel, you know, to do these jobs or anything. And let's say that comes up to $5,000. Basically, your income would be forty-five thousand, okay? Under the W-2 program, we don't need to see your tax return. So, we don't even submit your tax returns, we don't do any search and double-check those tax returns. All we submit are the W-2s and go off of that, okay? Which is pretty darn cool, okay? Because we've had three files in the past 30 to 45 days where they would not have qualified but since we have this W2 program, we don't need to see their tax returns, which is pretty awesome. 3. So, let me know if this helps. Let me know if you did not know this before....

Award-winning PDF software

No 4506 t mortgage Form: What You Should Know

Community Tax Service's Disaster Loan Assistance Program. The form shows which borrowers qualify for an emergency loan, so they can finance their home during or following a disaster. Your lender has an opportunity to show to the government at that time that you are a community member who has the ability to repay your loan, and that you do want to meet the terms of your disaster assistance loan. The form must be completed and sent to the Disaster Loan Assistance Program by November 22, 2022. Your loan is expected to be approved prior to November 2023, based on your ability to repay the loan. Form 4506-T: Instructions & Information — SBA This form allows SBA to be notified of the taxpayer who filed Form 4506-T. If you use this form, all borrowers will be identified as a community member, and they will not be required to provide more specific income information. In general, an application for disaster loan assistance requires only a social security number, and for a small-dollar disaster loan we do not use any other information from the form, since it isn't needed during the application process or otherwise has any effect on the processing of the disaster loan.

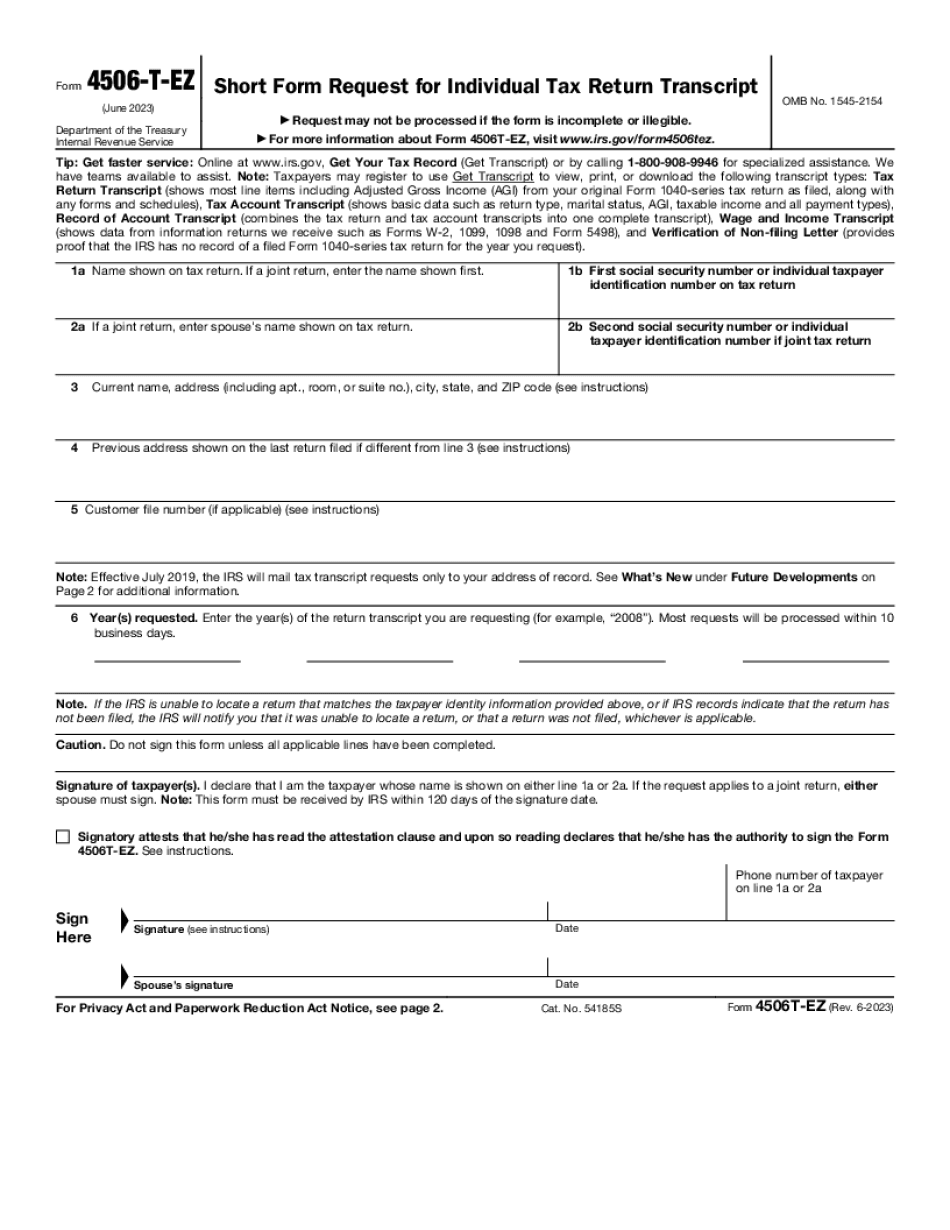

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4506T-EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4506T-EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4506T-EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4506T-EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing No 4506 t mortgage