Award-winning PDF software

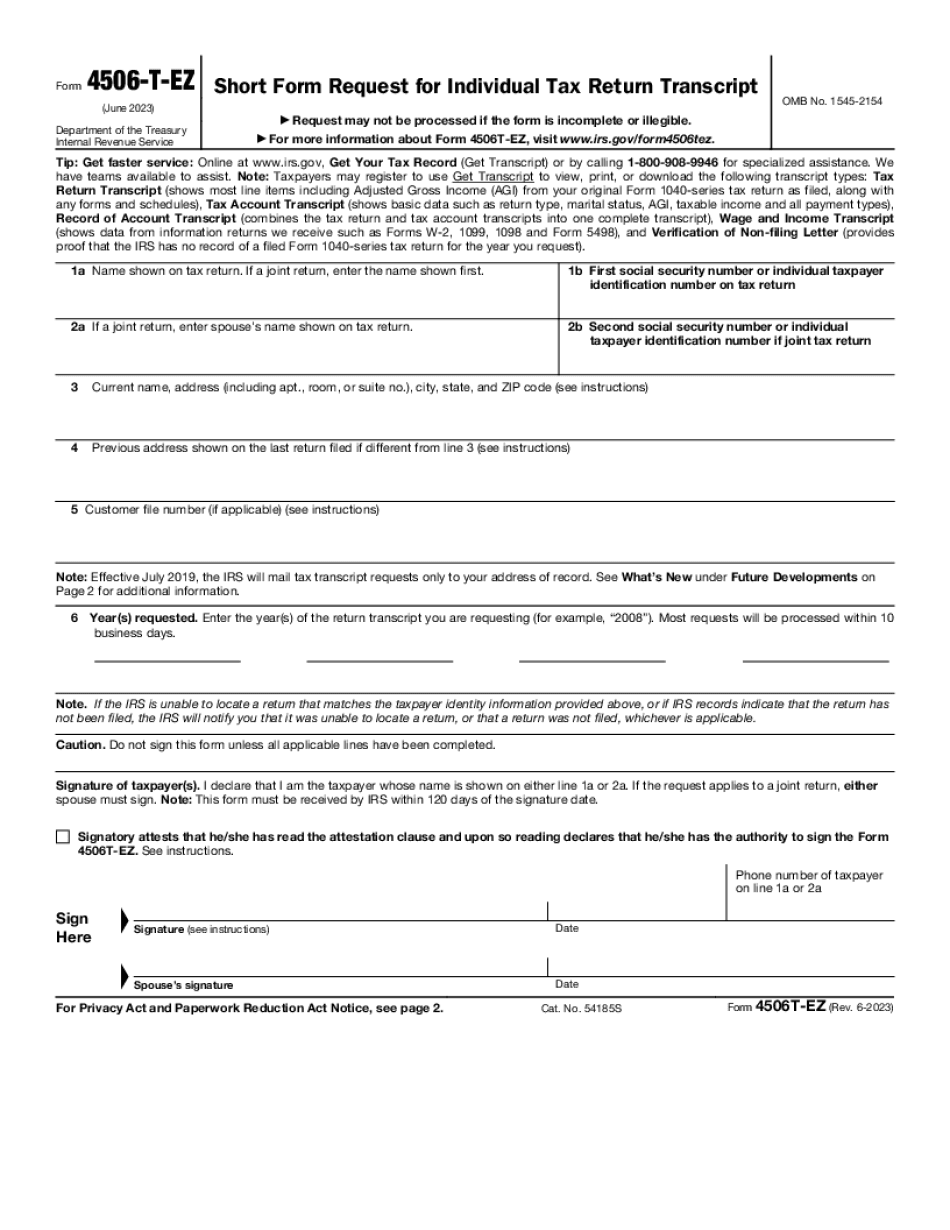

About Form 4506-T, Request For Transcript Of Tax Return: What You Should Know

See SBA's Disaster Loan Information for each program. The IRS must send your transcript and other information to SBA within 60 days of your filing date for all loan applications (including those for assistance as described in Section 17 of the Disaster Relief Appropriations Act of 2025 [P.L. 112-74] and Disaster Relief Appropriations Act of 2025 [P.L. 113-66]). See The transcript request page. To receive disaster loan repayment assistance, you must use Form 4506-T and make arrangements to receive your transcript from SBA. This must be done within 15 days of receiving your tax return information. If you did not file a tax return, you will need to complete Form 4506-U (see below) and a letter requesting a transcript.

Online systems help you to to organize your doc management and enhance the productiveness within your workflow. Follow the short information in an effort to total About Form 4506-T, Request for Transcript of Tax Return, keep clear of faults and furnish it inside a well timed method:

How to accomplish a About Form 4506-T, Request for Transcript of Tax Return on line:

- On the web site while using the variety, click Begin Now and pass into the editor.

- Use the clues to complete the applicable fields.

- Include your individual facts and speak to data.

- Make confident you enter accurate facts and numbers in proper fields.

- Carefully check the content within the variety also as grammar and spelling.

- Refer that will help section if you have any queries or handle our Help team.

- Put an digital signature in your About Form 4506-T, Request for Transcript of Tax Return when using the aid of Signal Instrument.

- Once the form is completed, push Executed.

- Distribute the completely ready type through email or fax, print it out or help you save in your unit.

PDF editor allows for you to make improvements in your About Form 4506-T, Request for Transcript of Tax Return from any online world related equipment, personalize it as reported by your preferences, signal it electronically and distribute in several tactics.