Award-winning PDF software

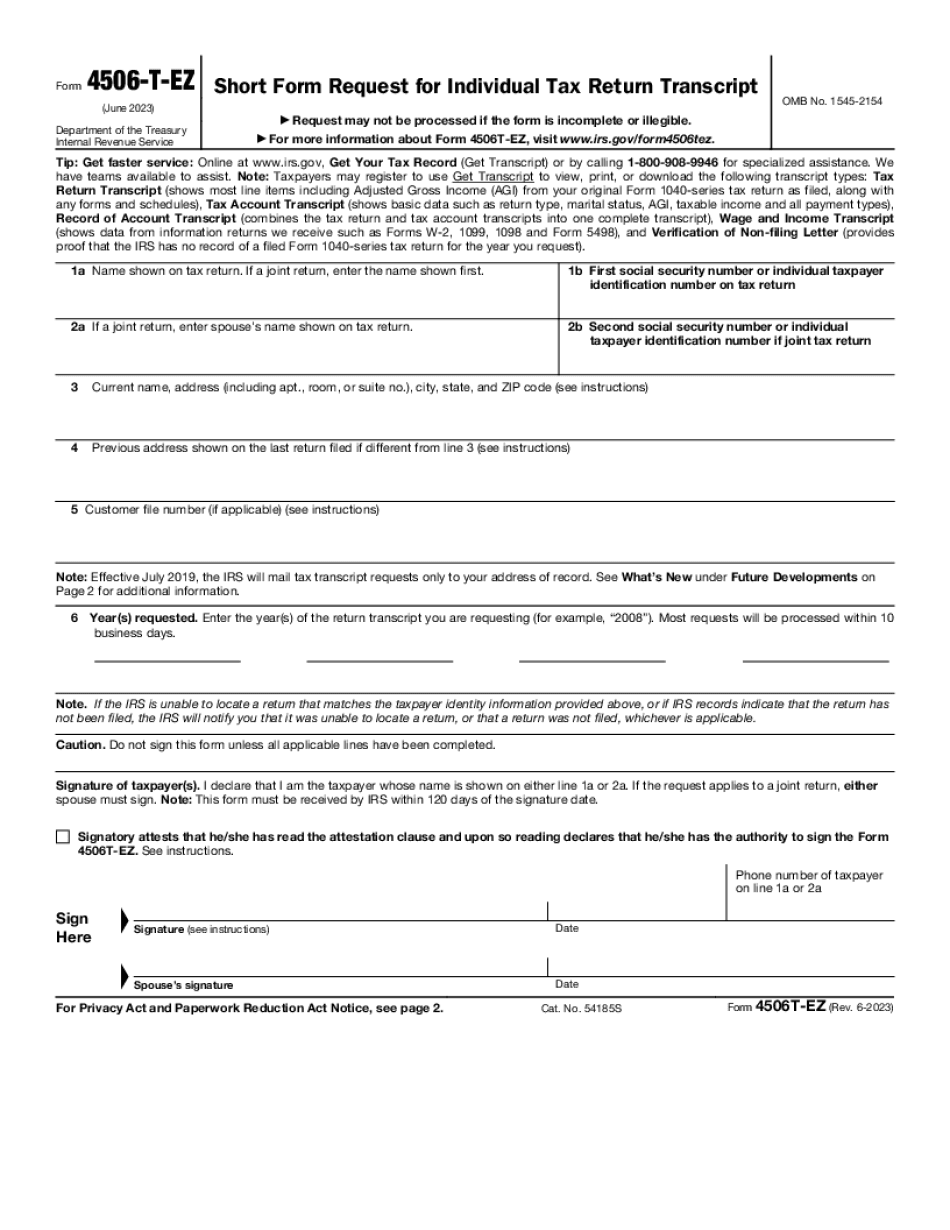

Request For Transcript Of Tax Return - Internal Revenue Service: What You Should Know

Get Transcript | Internal Revenue Service Aug 25, 2025 — online Disaster Requests for Transcript of Tax Return — TECH: A form (Form 4868T) is being used with this website page. Please use this form and file your application as directed by your local tax office. Get Transcript | Internal Revenue Service Feb 25, 2025 — By mail: Send your completed Tax Transcript application to: Office of Tax. Transcripts. TECH Transcript Requests. Mar 24, 2025 — By online : Visit the website and click on Get Transcript. Online Get Transcript Mar 24, 2025 — BY fax: Send your completed Tax Transcript application to: Office of Tax. Transcripts. TECH Transcript Requests. Mar 24, 2025 — By e-file : Send your completed Tax Transcript application to: Office of Tax. Transcripts. TECH Transcript Requests. The transcript may be sent via e-file using TaxA ct.gov. You will need to have a valid EIN and a certified e-file receipt at time of payment. Get Transcript | Internal Revenue Service Oct 15, 2025 — BY mail: Send your completed Tax Transcript application to: Office of Tax. Transcripts. TECH Transcript Requests. Mar 24, 2025 — By online : See the link below for a web link to obtain Tax Transcripts for the current tax return.

Online alternatives make it easier to to organize your document management and boost the productivity within your workflow. Carry out the quick guideline for you to finished Request for Transcript of Tax Return - Internal Revenue Service, steer clear of mistakes and furnish it within a timely way:

How to complete a Request for Transcript of Tax Return - Internal Revenue Service on the internet:

- On the web site while using the type, simply click Commence Now and go towards editor.

- Use the clues to fill out the related fields.

- Include your own information and make contact with info.

- Make convinced that you enter suitable knowledge and figures in best suited fields.

- Carefully look at the information within the sort likewise as grammar and spelling.

- Refer to help you part when you've got any problems or deal with our Service group.

- Put an electronic signature on the Request for Transcript of Tax Return - Internal Revenue Service aided by the assistance of Signal Software.

- Once the shape is finished, push Finished.

- Distribute the ready sort through email or fax, print it out or conserve on your own equipment.

PDF editor lets you to make changes with your Request for Transcript of Tax Return - Internal Revenue Service from any internet connected device, personalize it according to your requirements, indicator it electronically and distribute in several options.