Award-winning PDF software

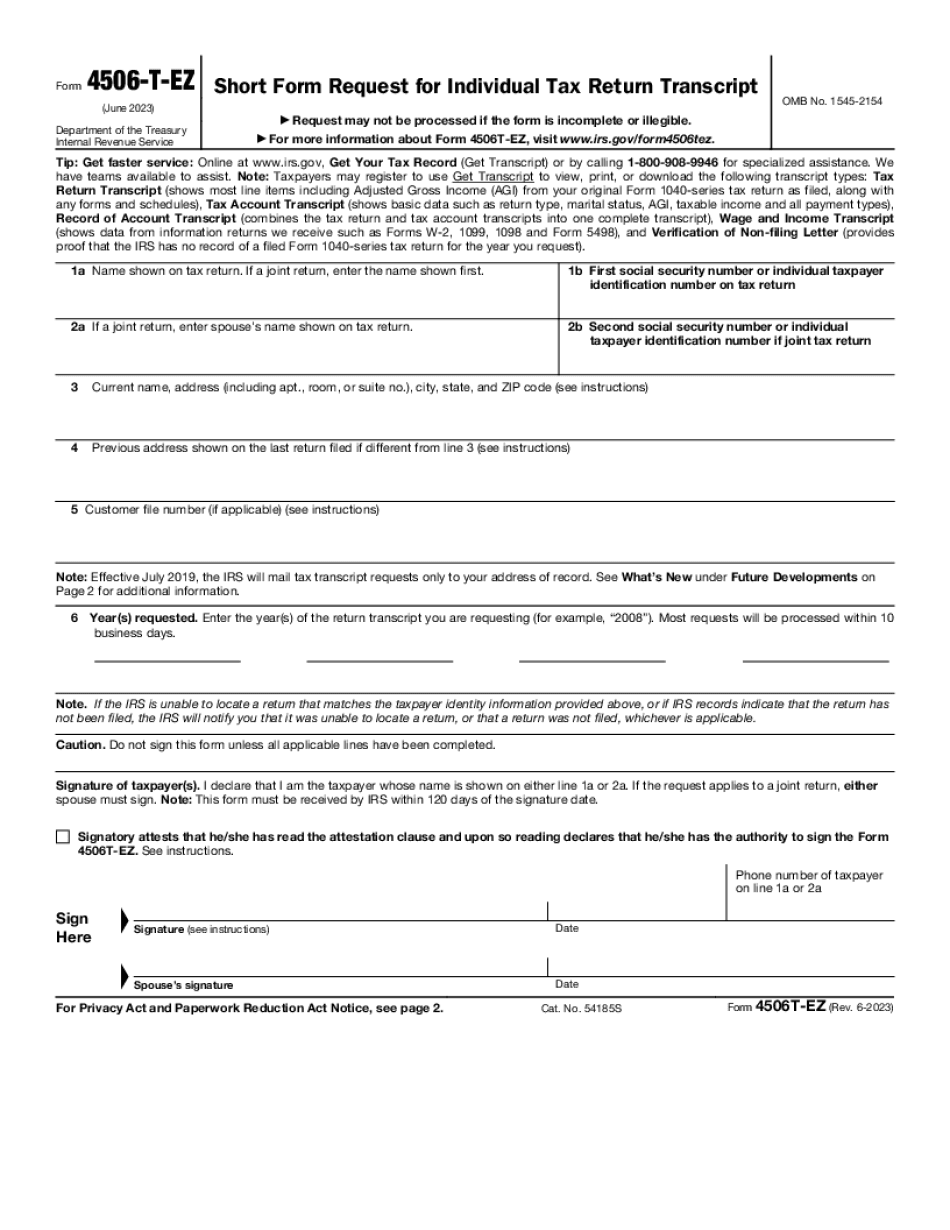

Attachment To Gen-13-16 Irs Tax Return Transcript And: What You Should Know

For tax returns Filed on Line 3 of Form 1040: Filing Situation. (CRS-5-08) This chart is included as an attachment to this notice to help provide you the information you need to make a decision when it comes to selecting a tax return transcript, requesting a copy of your prior tax return, or asking the agency to use your account information for an investigation involving a potential tax return deficiency. For tax returns Filed Online and For Tax Returns Filed on Paper Forms: Filing Situations. (CRS-7-23) This charts is included as an attachment to this notice to help provide you the information you need to make a decision when it comes to choosing a tax return transcript, requesting a copy of your prior tax return, requesting a copy of your tax return. For tax returns filed on Paper Forms: Tax Filer Filing Situation. (CRS-11-15) This chart is included as an attachment to this notice to help provide you the information you need to make a decision when it comes to selecting a tax return transcript, requesting a copy of your prior tax return, requesting a copy of your tax return, or asking the agency to use your account information for an investigation involving a potential tax return deficiency. For tax returns filed electronically on Line 14B of the Tax Master File; Form 1040EZ (CRS-12-15) This charts is included as an attachment to this notice to help provide you the information you need to make a decision when it comes to selecting a tax return transcript, requesting a copy of your prior tax return, requesting a copy of your tax return, or asking the agency to use your account information for an investigation involving a potential tax return deficiency. For tax returns filed on Line 14C of the Tax Master File; Form 1040 (CRS-16-34) This chart is included as an attachment to this notice to help provide you the information you need to make a decision when it comes to selecting a tax return transcript, requesting a copy of your prior tax return, requesting a copy of your tax return, or asking the agency to use your account information for an investigation involving a potential tax return deficiency.

Online remedies enable you to to organize your document administration and improve the productiveness of one's workflow. Go along with the quick manual with the intention to full ATTACHMENT TO GEN-13-16 IRS Tax Return Transcript and, keep clear of glitches and furnish it inside a well timed method:

How to finish a ATTACHMENT TO GEN-13-16 IRS Tax Return Transcript and online:

- On the website along with the form, simply click Begin Now and pass for the editor.

- Use the clues to complete the relevant fields.

- Include your personal facts and get in touch with information.

- Make convinced you enter suitable material and numbers in best suited fields.

- Carefully look at the material with the type likewise as grammar and spelling.

- Refer to aid section if you have any queries or deal with our Guidance workforce.

- Put an electronic signature with your ATTACHMENT TO GEN-13-16 IRS Tax Return Transcript and while using the aid of Indicator Instrument.

- Once the form is done, press Completed.

- Distribute the prepared form by way of email or fax, print it out or save on your machine.

PDF editor permits you to make variations on your ATTACHMENT TO GEN-13-16 IRS Tax Return Transcript and from any world wide web linked device, personalize it in accordance with your requirements, indicator it electronically and distribute in several techniques.