Award-winning PDF software

form 4506t-ez: request for individual tax return

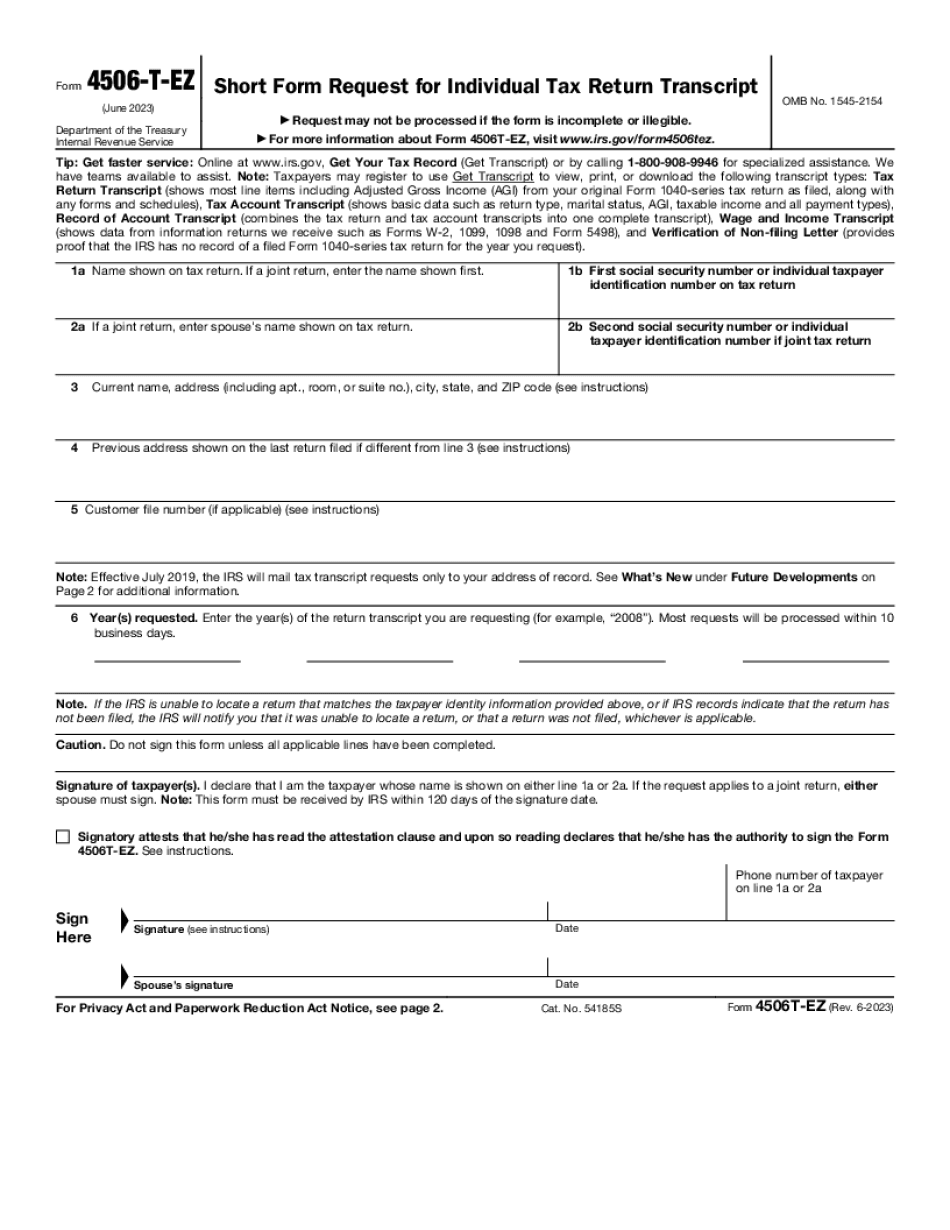

See Form 4506-T for more details. For questions or more information, e-mail us, call us, or visit us online. Forms 4506-T/TIMES (for all businesses) is the new and updated version of Form 4506-T. The information on this page is for informational purposes only. Please note that this document is not a substitute for legal advice from an attorney. We recommend that you contact an attorney to discuss your specific situation before using this information. Tax Form 4506-T is a mandatory tax form for all businesses (or self-employed individuals), including: retailers; commercial real estate operators; operators of a nonprofessional business; investment and trade operations that make a net profit of more than 10,000 within the tax year; businesses that trade commodities or are in a commercial activity (and not just trading); businesses whose gross receipts exceed 600,000, except banks, savings and loan associations, insurance companies, brokers, and dealers; commercial fishing vessels; passenger ferries; cargo ships; subsidiary businesses of a public utility; and Fishermen. If.

form 4506-t: instructions & information - community tax

While a completed version of IRS Form 4506T-EZ can be sent electronically to the IRS, you must be able to physically deliver one to your local IRS office for use in completing Form 1040 and Form 4506. Taxpayers should also note that IRS Forms 4506T-EZ are not available electronically. If you need to obtain a transcript of your individual tax return, you can still do so by completing and filing IRS Form 4506T. The original is available to the IRS in a sealed envelope. The current version of Form 4506T is available on. To learn about how the IRS can help you prepare your taxes, visit our Taxpayer Assistance Centers. See also: How to Prepare an IRS Tax Bill What do I need to do if there is a mistake on my tax return? You are not able to correct corrections to your original return without first being issued a corrected tax return..

form 4506t-ez fill online, printable, fillable, blank

PDF If you have additional information or questions regarding the contents of the transcript please contact the IRS, or call them in Austin/Hill Country at or 1-800-TAXES-TAXES for information and assistance. There are two types of Internal Revenue Service Transcripts; Regular and Short. The Short Forms are used for taxpayers who do not require additional documentation or additional explanation within the Full Form. However, the Short Form would still be a useful form to give to a taxpayer if you wanted it without needing additional assistance. So in summary, there are two types of transcripts and both can be helpful depending on the number of years or even if your records or answers are already in the IRS system. Remember, if you have ever had your tax questions resolved by the IRS you know that the IRS is always a go-to agency in all matters related to taxation. The IRS Transcript Service is open year round.

form 4506-t - fillable & printable | free pdf download

For more information and a free download of the form, click here. If you have an e-file or a direct deposit account with the IRS (such as through Paycheck forward, Direct Deposit, or Set Up an Online Account), then you'll also get a Request for Transcript of Tax Return.

tax return transcript request process

Gov e-file due date adjustment for any individual claiming a refundable credit for the year the individual filed his or her return using Form 4506-T. It does NOT include an individual claiming a refundable credit for a prior year since the date of the earlier return under the prior year's social security number is not the same as the date the individual files under either Form 4506-T or Form 4485. Taxpayers can access a list of eligible income tax years by using the link at the top of the page. You can download your e-file by visiting or you can download it by printing it and completing Form 4506T-EZ on one of the following: Paper form Download Form 4506T-EZ by visiting or by printing it and completing it on one of the following: • IRS Form 4506T-EZ should be used instead of IRS Form 4506-T because it is sufficient to.