Award-winning PDF software

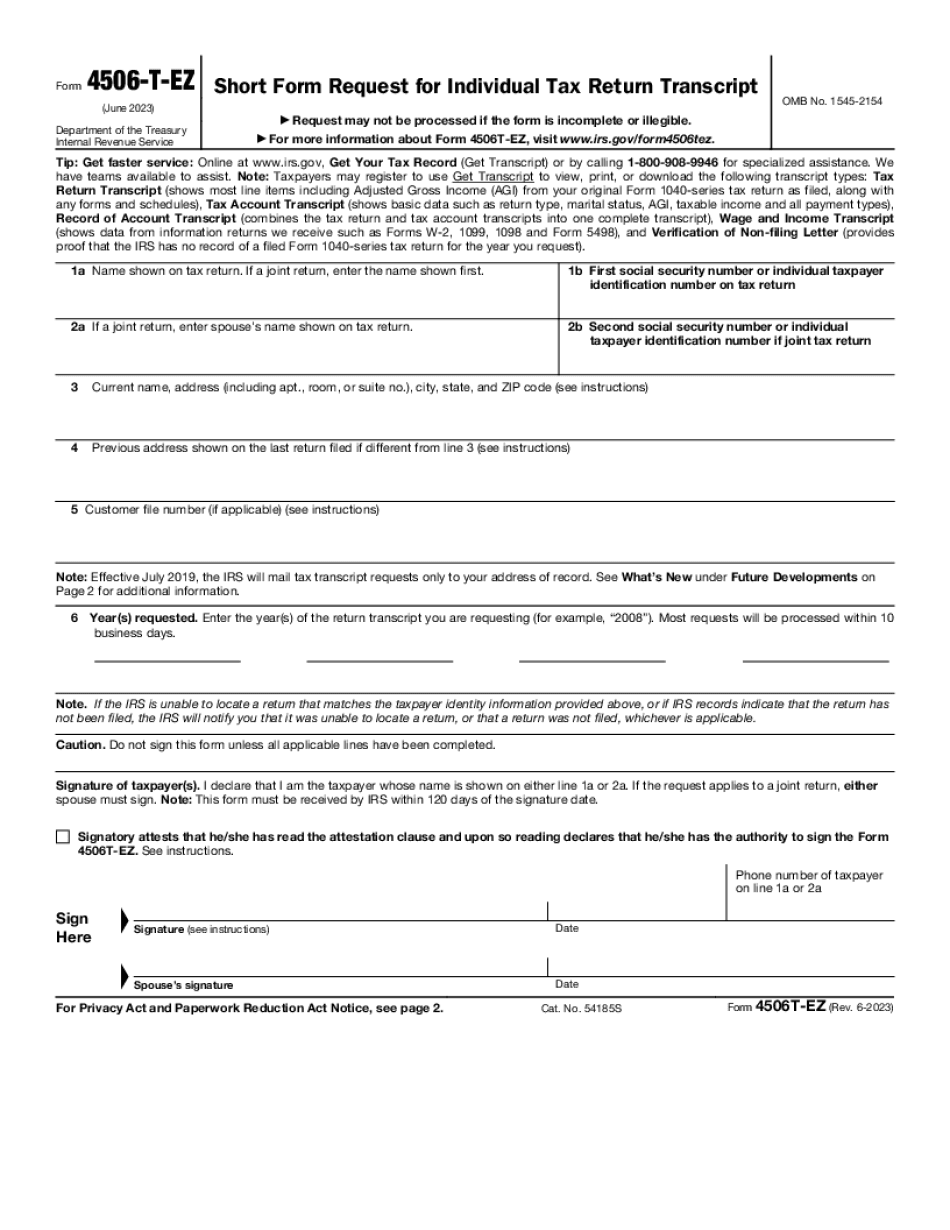

Concord California Form 4506T-EZ: What You Should Know

How to File You can obtain a copy of your tax return with a valid tax preparer. You do not need to complete, sign or file Form 4506T-EZ. Use the form online or by fax. You should report all income on your form 1040. Taxpayers without income reported on their annual return should complete the Form 1040NR or Form 1040NR-EZ to indicate they received Form 4506T-EZ and can still file if they have one of the following tax reporting adjustments on their return: Exemptions: Additional Tax on Qualified Domestic Production Activities (IRC Section 75, IRC Section 83 or IRC Section 90; or Interest or Gain on Certain State and Local Taxes (IRC Section 62(c)(2); or Nonrefundable Credit (IRC Section 66), Excess Qualified Dividends (IRC Section 1374E), Qualified Dividends Received by a Foreign Corporation (IRC Section 1374J), Qualified Dividends Received by A Foreign Partnership (IRC Section 1374J), or Qualified Dividends Received by A Foreign Trust (IRC Section 1374J). Tax Returns: Earned Income Credit (IRC Section 65) on certain workers who file Form W-2 and not a Form 1040 (but not on self-employed individuals filing Form 1040). If you don't file or if you have an adjustment that is on this form, you will be filing an electronic filing (e-filing) form, but you can obtain a copy of your tax return on line 2 of Form 1040 or Form 1040NR. Qualified Dividends: If the dividend is from a noncorporate entity and the taxpayer receives a W-2 from the entity (not a Form 1099-R), the taxpayer should report and pay tax on the dividends. The dividends are treated as capital gain dividends. On the Form 990, the 10% box should not match the amount of the dividend. Payments: If you are a qualified joint and survivor estate, any payments that are subject to a 4% or 10% additional tax are reported on Form 990 or Form 1040 depending on whether the payments consist of income or capital gain dividends. The 4% additional tax is calculated on the gross income for the year, not for the particular year of the payments. However, payments made to deceased spouses, surviving spouses, widows and widowers are reported on the individual's return for the year of death.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Concord California Form 4506T-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Concord California Form 4506T-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Concord California Form 4506T-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Concord California Form 4506T-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.