Award-winning PDF software

Form 4506T-EZ Dayton Ohio: What You Should Know

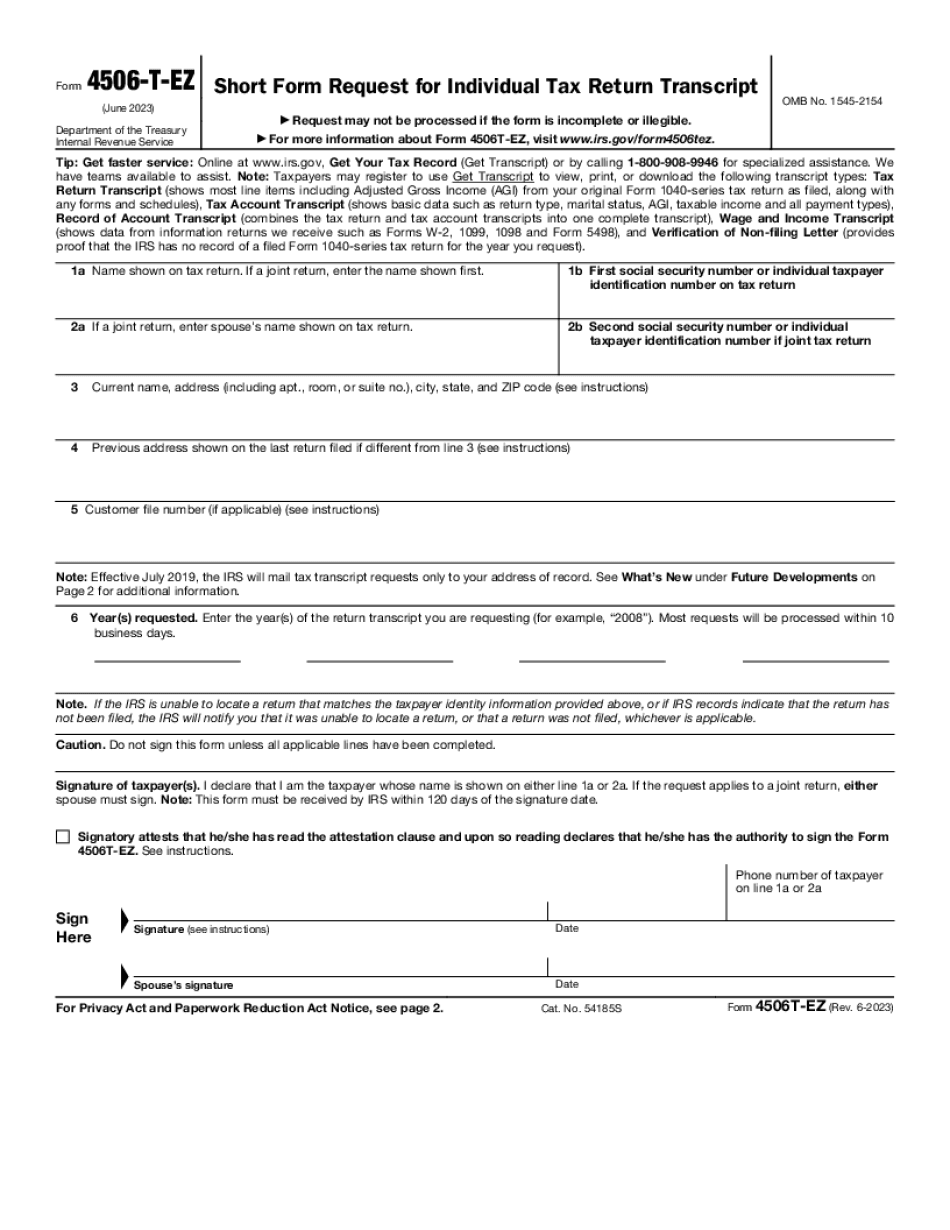

See the official SBA page for more info on the program: Loan Application Process The IRS can only issue new loan applications for disaster loans if the IRS determines that you are a low-income eligible individual that is also eligible for the COVID-19 Disaster Loan Program and that you are currently receiving food pantries, clothing closets, emergency food distribution, and other federally-assisted disaster-relief funding. We want to assure you that our offices will not hold on to your transcript for more than 72 hours before mailing the transcript and instructions. Important Dates (if you have already made your tax return) Sep 30, 2025 — Final Transcripts are issued. Get them in the mail. Nov 30, 2025 — IRS is closed for Thanksgiving & Christmas. Sorry, we must be closed. Dec 30, 2025 — Your Transcript is mailed back. The transcript may be given to your financial aid office for approval. If so, you will receive it the next business day (if you are in the mail). If not, it will be mailed back around December 28, 2018. Form 4506-T-EZ (Rev 11, 2021) Form 4506-TEZ (Rev 4-1799) Form 4506-TEZ — Application for Individual Tax Return Transcript For more information about Form 4506-TEZ, visit. Notice We have now been able to issue Form 4506-TV for individuals who live in rural and urban areas. In 2016, we ran out of our old Transcript Form 4506-T-EZ. Because of this we began to issue new Transcript Form 4506-TV. To obtain Form 4506-tv visit. You can use Form 4506-tv to submit your tax return and get any other information. If you are completing Form 4506-T-EZ, you do not need to complete the form if you have requested a pre-paid transcript. As a result, in many cases we were able to deliver our own pre-paid transcript. You will not need to complete the form if you have already filed a timely tax return. If you are completing Form 4506-T-EZ, if you get a W-2 and if you received an extension for filing, you may not have to complete the form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ Dayton Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ Dayton Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ Dayton Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ Dayton Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.