Award-winning PDF software

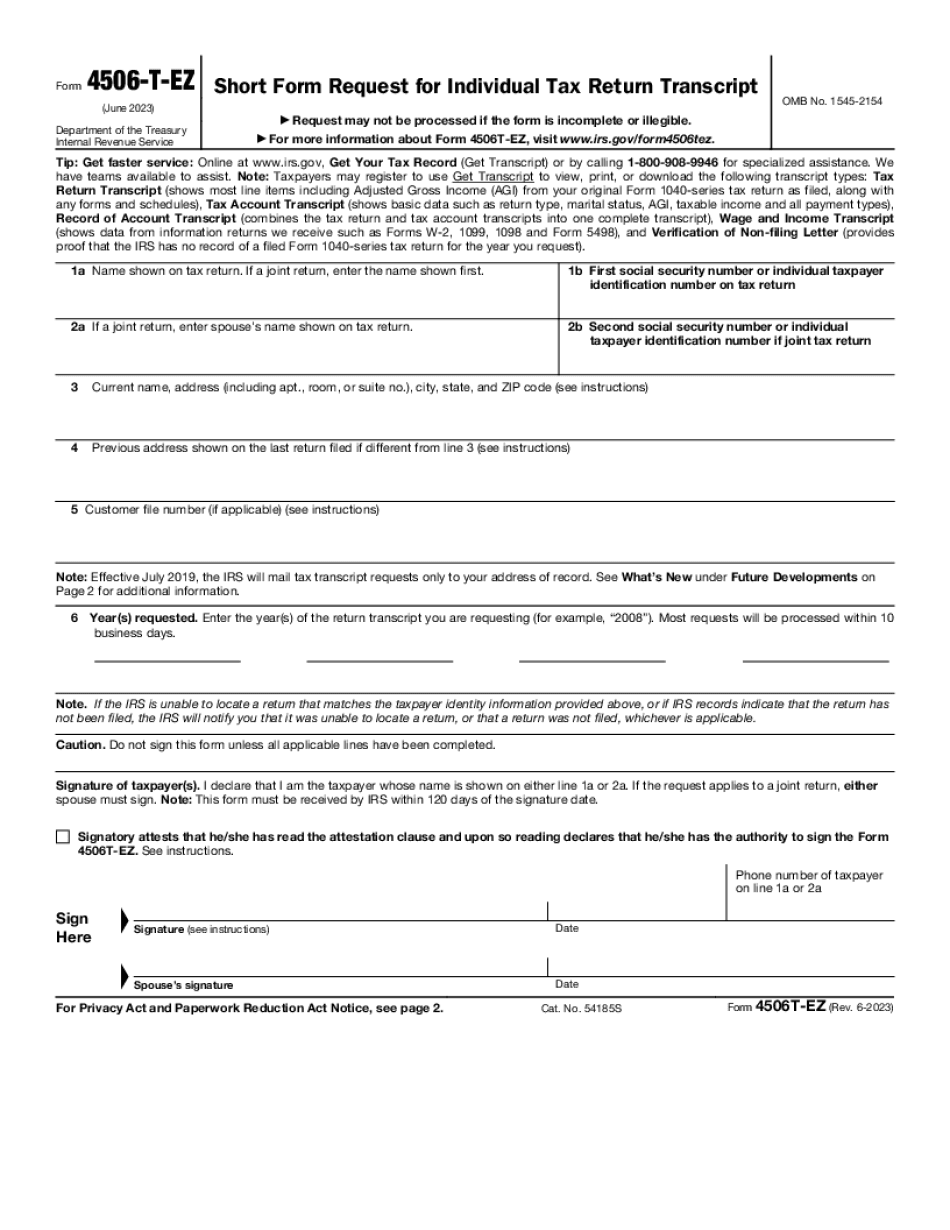

Form 4506T-EZ for Frisco Texas: What You Should Know

Required Taxpayers in Disaster Area for Disaster Relief Tax Relief Payments Those taxpayers whose businesses or properties are required to remain closed for the duration of a disaster, whether a disaster declaration has been issued or not, may be eligible to receive tax relief payments from the U.S. Small Business Administration (SBA). These payments may be made through SBA's disaster loan insurance program or by SBA directly, through disaster loans. Please read the following SBA disaster loan page to learn all the requirements to get and receive disaster relief loans through SBA. If this is applicable to you, read the following article which will provide further SBA contact information: Disaster Loan FAQ About Disaster Relief from SBA disaster relief program for small businesses and the economy in general may require the participation of non-profit organizations (such as 501(c)(3) entities), non-profits that have 501(c)(4) tax-exempt status, charities, or government, federal and state, or municipal organizations. FREQUENTLY ASKED QUESTIONS Q1: What is disaster relief? A1: Disaster relief programs are a way to provide monetary and in some cases non-monetary assistance to individuals and entities that experience a disaster such as wildfires, earthquakes, and severe storms. Disaster relief programs provide resources, such as money, medical attention, food, shelter, and more, that can be helpful in recovering from a disaster. Q2: How is disaster relief different from small business aid? A2: These are separate programs with slightly different eligibility requirements. The disaster relief program for small businesses and individuals provides immediate financial assistance as well as other types of relief. Q3: Which is the primary purpose of the SBA Disaster Relief Program? A3: The primary purpose of SBA disaster loan programs is to provide cash and non-monetary relief through the establishment and management of a loan fund to pay for the costs of natural or man made disasters. Q4: Is the SBA responsible for making the disaster relief funds available to individuals and businesses? A4: The SBA will administer the disaster loan programs in coordination with FEMA. However, SBA is not the lender of last resort. SBA will not participate in a business's bankruptcy proceedings.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ for Frisco Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ for Frisco Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ for Frisco Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ for Frisco Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.