Award-winning PDF software

Form 4506T-EZ for Kansas City Missouri: What You Should Know

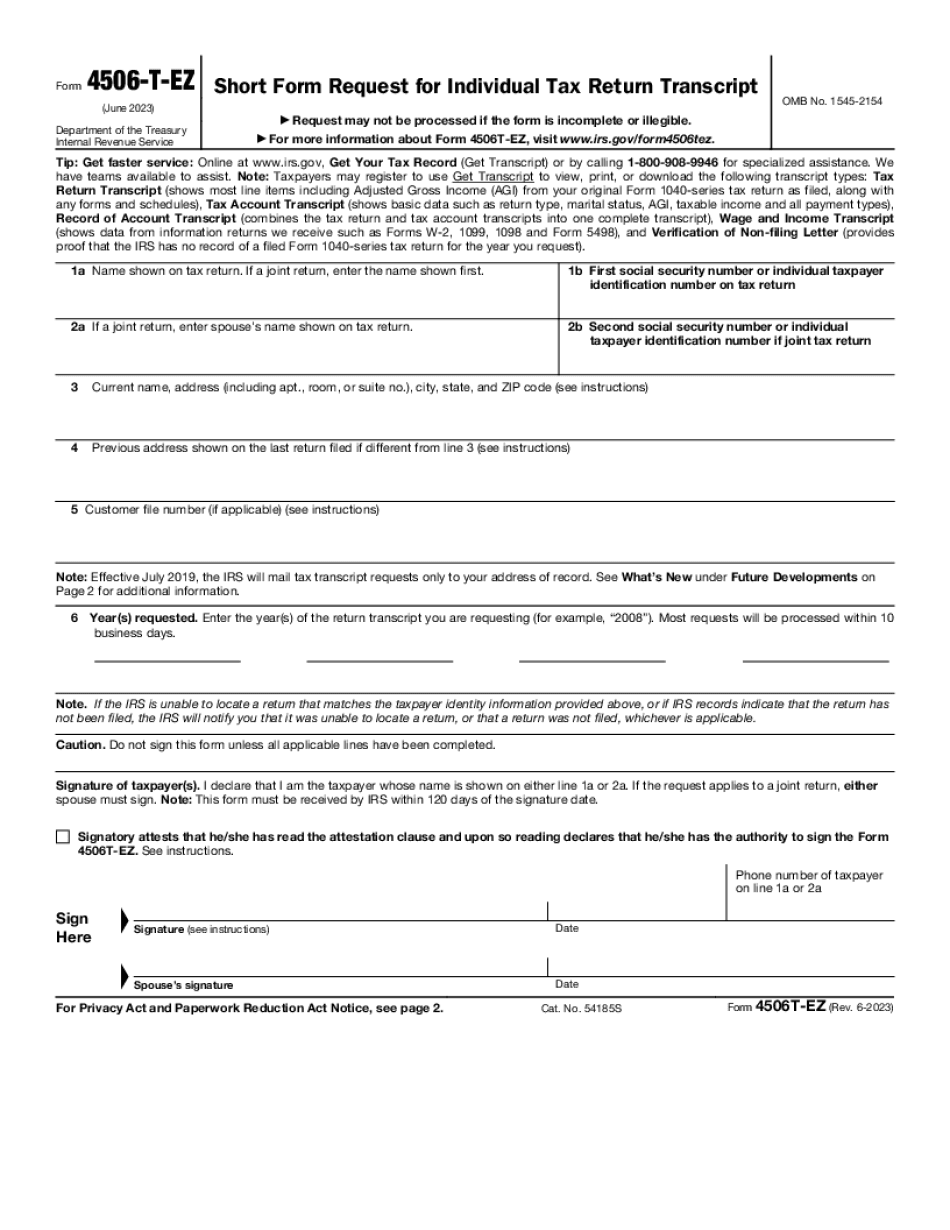

This means you must provide the following information and attachments when requesting a Tax Return Transcript. What is a transcript, and why are they necessary? Transcripts are pieces of paper provided by the IRS that record or summarize the information in a tax return. In addition, they are the records retained by the IRS to satisfy the obligation to send a timely and complete return to the taxpayer. These records serve to make sure that the return is complete. A tax transcript also serves to document to the Internal Revenue Service the date the tax was paid or received. Informational Transcripts — PDF/ATQ_transcripts.pdf If I have a tax payment, how long does it take to receive my tax transcript? Please check with the mayor and the payee for an estimate of how long it may take for the IRS to process your payment. What documents do I also need when requesting my tax return transcript? All transcripts, along with a request to make changes to the transcript, must be accompanied by documents showing the year, month, and year of the tax return. When submitting the complete tax return, the applicant must include a complete copy and summary, showing the income, deductions, credits, and tax withheld. Tax year is not required for individual taxpayers requesting a Tax Return Transcript. However, if a taxpayer is filing for the 2025 tax year, they must submit tax year information with the most recent tax return filing. This year's tax year is January 1, 2017, to December 31, 2017. Do I have to file a new tax return in order to use the IRS Tax Transcript service? A Tax Return Transcript has two uses: (1) it allows tax filers to get a copy of their tax return and (2) allows the payable government agencies to provide a transcript. You can access your tax return by requesting an individual Tax Return Transcript. When requesting an individual Tax Return Transcript, the information and any attachments requested must be sent directly to the correct mailing address. This is a completed tax return form and two pages of supporting information must be attached: Tax Return Form 4506 | IRS Tax Return Transcript Request Form — Schedule N-400 Form 4506-T-Z (Rev. 11-2021) — IRS Tax Return Transcript is an optional service available to individuals who meet the requirements.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ for Kansas City Missouri, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ for Kansas City Missouri?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ for Kansas City Missouri aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ for Kansas City Missouri from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.