Award-winning PDF software

Form 4506T-EZ online Provo Utah: What You Should Know

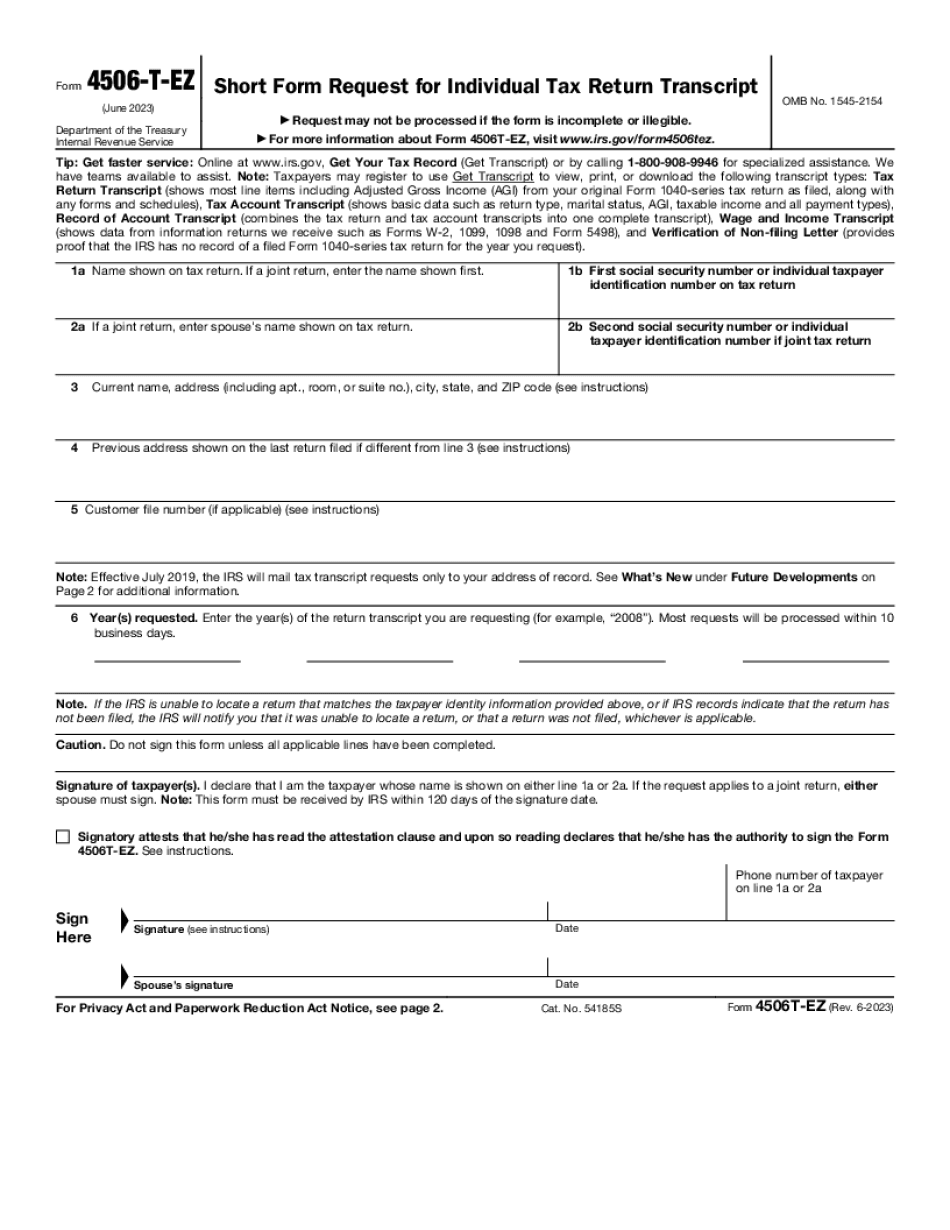

IRS Form 4506-T — SBA Filing the Form 4506-T for individuals is very similar to filing a joint return. It is useful for individuals with multiple incomes but can only be used by those who are requesting tax return transcripts, tax account information, W-2 information, 1099 information, and the Federal income tax (FIT) Form 1098-T for the year reported. To use this form, an individual (not a family) must complete and file a separate Form 4506-T for each person whose name is listed. Also, the individual(s) must include an IRS Form 4506 (a) to show that the person has not filed a Tax Return and (b) to show the total income. In most cases, Form 4506-T is filed by the IRS during the Filing Season. An individual not filing a tax return must use Form 4506-T-EZ to request tax transcripts, tax account information, W-2 information, 1099 information, and the Federal tax (FIT)-Form 1098-T. In addition, the person must pay back FIT (1098) for any year the individual didn't file and pay back interest. The Federal Form 4506 (Form 45006) is not necessary. The IRS Form 4506 can be faxed at. However, the Federal Form 4506 does not have any penalties. However, if the person doing the work does not have the correct IRS filing requirements, they will be considered to have violated the IRS Criminal Offenses Reporting (COR) system and will be liable to pay a fine of 3500 for each violation to the IRS. Filing an Individual tax return is the opposite of filing a joint return. While the tax return does not have to be filed the same day, it must be filed within 60 days, or it will not be treated as completed. The tax return is a joint document from the first-degree relative. The individual with the highest net taxable income on the joint return is considered the taxpayer. The individual does not usually have to sign if signed in the usual way. The individual with the lowest net taxable income on the joint return is not considered the taxpayer. The individual may sign as many forms as he/she wishes to complete the return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ online Provo Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ online Provo Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ online Provo Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ online Provo Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.