Award-winning PDF software

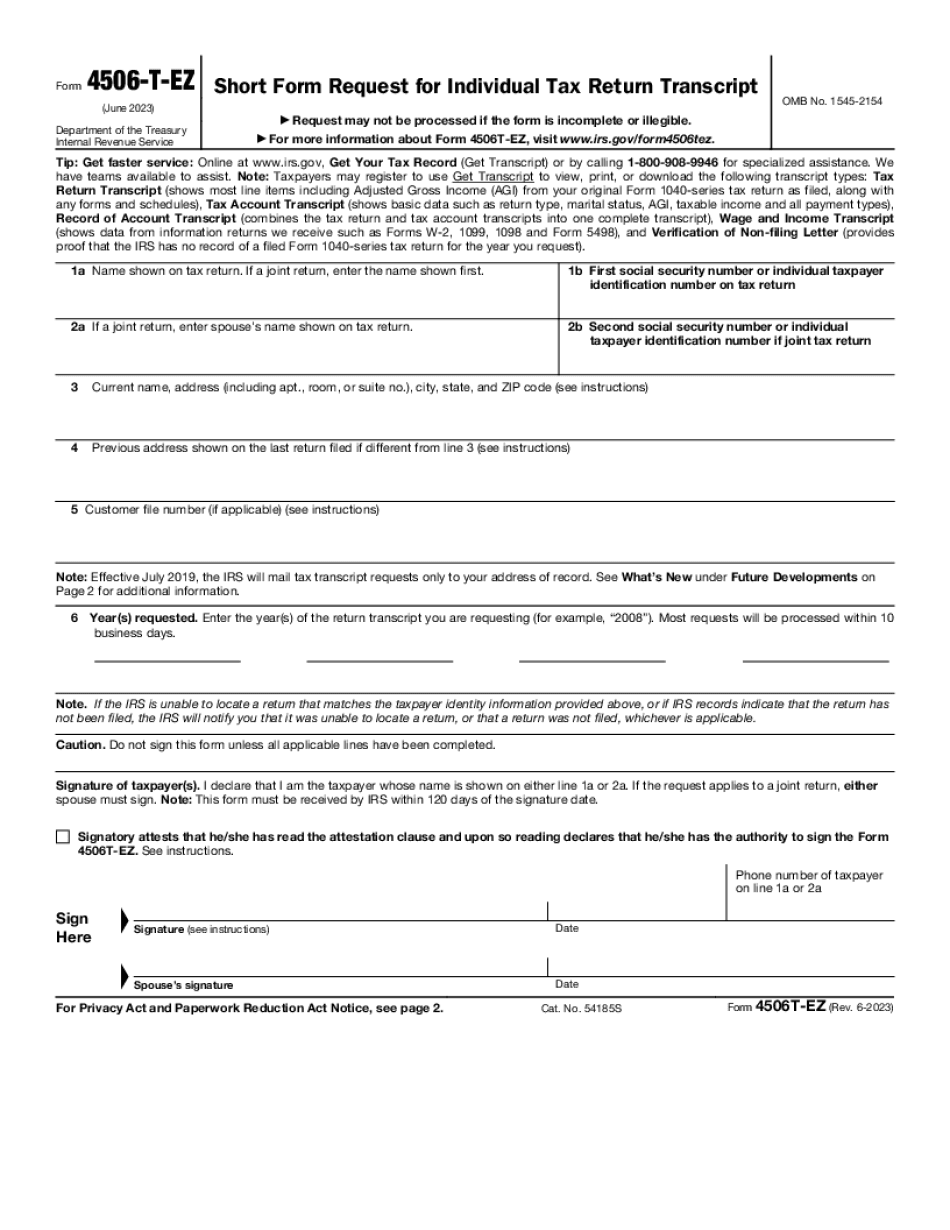

Form 4506T-EZ Salt Lake City Utah: What You Should Know

In 2012, there were reports that individuals were submitting a Form 4506-EZ claiming credit for the interest they had paid on an SPS-FHA adjustable-rate home mortgage loans. This allowed some SPS loan borrowers who did not owe any federal taxes to have their income-based repayment loans reduced by the amount of interest they paid. That same year, the IRS announced in the “Annual Tax Tips Bulletin”, that a change to the “Electronic Filing of Individual Tax Returns with Certain Electronic Documents” would be implemented, and that all users of electronic filing systems—without exception—must have an IRS e-file code. The new IRS Electronic Filing Code allows taxpayers to file their own returns electronically using only one IRS e-file code. Electronic filers can also file by sending their original Federal income tax return to IRA, and then electronically faxing it back to IRA where it is completed and returns are sent electronically to the taxpayer. If this is the first time you have filed a paper return and are using an IRS e-file code, you will not need to use the original Form 4506-T on line 10. Instead, the Form 4506-T will be filled in on the electronic format. For additional information, click here. The following section outlines the details of Form 4506T for a borrower. (We will update this to reflect changes made in the 2025 tax year on 8-17-2013.) To use Form 4506T to file a federal tax return electronically, fill in all fields on page 1 of Form 4506T before completing “Signature and Date.” Enter a 3 digit Social Security Number (SSN) shown on Line 15 of the application form. To ensure your SSN matches the SSN of an individual who is using your Form 4506T, or to obtain an updated income source, you may need to call your creditor and pay all or part of the debt on their behalf, since the creditor can verify your SSN in its records. For more information, visit IRS.gov/OEP. The SPS-FHA is a loan program provided by the U.S. Department of Housing and Urban Development (HUD). As of 10/1/2011, if you are a student loan borrower on an SPS-FHA loan who paid interest on the loan, there is no interest deduction from the student loan due to income tax requirements. For more details, visit IRS.gov/SPSFHA, IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ Salt Lake City Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ Salt Lake City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ Salt Lake City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ Salt Lake City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.