Award-winning PDF software

Springfield Missouri Form 4506T-EZ: What You Should Know

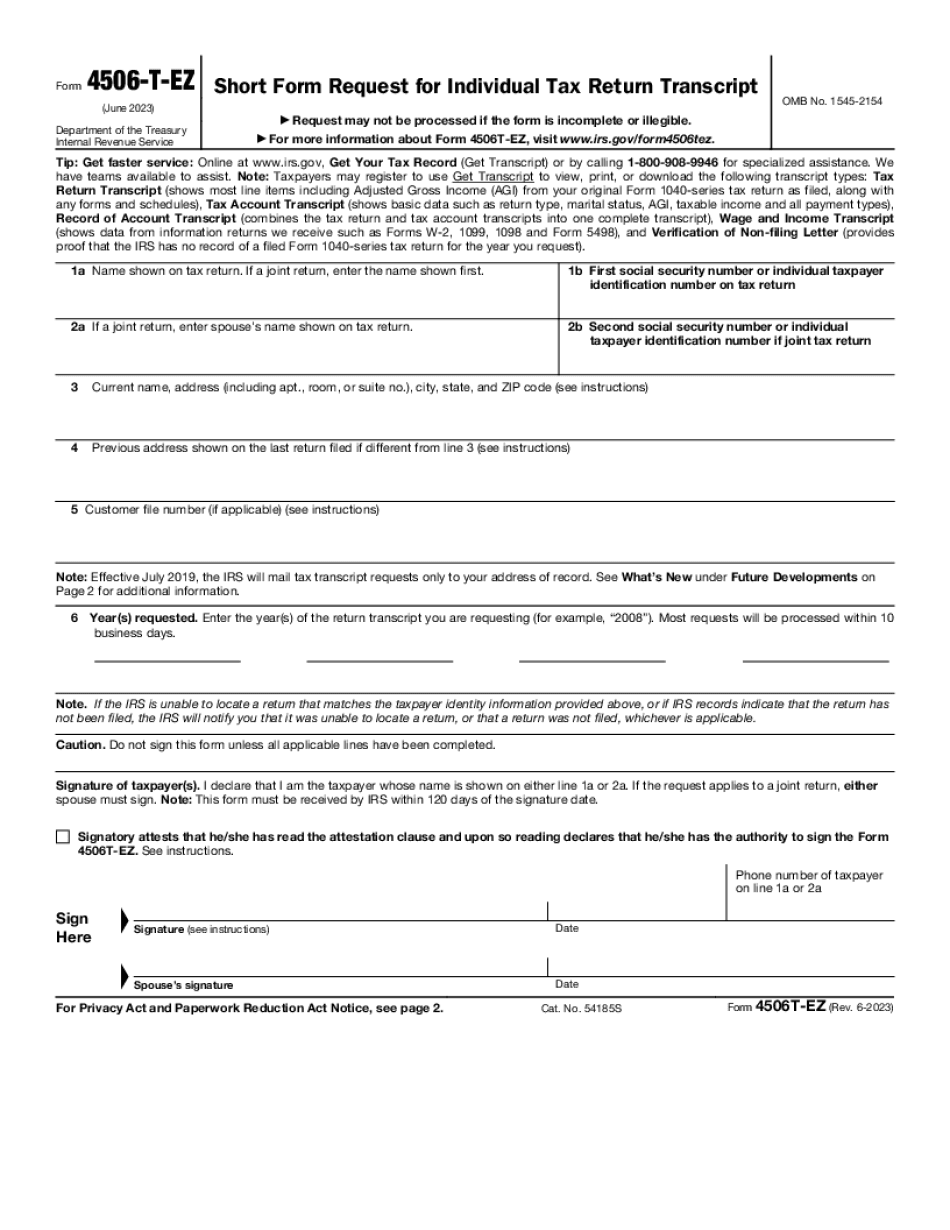

Receipt Form 4506T-EZ. It is an electronic version of Form 4506t — EZ that includes information about the number of pages to use in constructing it and has both PDF and Microsoft Excel versions. Print the form and use the PDF version for electronic filing. Print Form 4506t-EZ, use the PDF version and then manually fill in all the fields. Form 4506t-EZ Downloading PDF Tax Return Transcript (Form 4506T-EZ) If the total of all the pages of the PDF are greater than 8.5 × 11 inches, the IRS recommends that the PDF document be printed on at least 8.5 inch by 11 inch paper, using a color printer, and saved on CD or DVD. The tax return Transcript may be filed electronically using a free program provided by the U.S. Department of State or a certified email program. The IRS does not endorse any one particular program or software application. Using a free software program may allow you to prepare the transcript in a fraction of the time it would take to prepare an ITIN Transcript. The following tax preparation software programs are available for free download: Census Bureau Information Exchange Program for file for Tax Microsoft Office Word, Excel, and PowerPoint Using Microsoft Word, Excel, and PowerPoint to create PDF tax return Transcripts. The IRS maintains a database of ITIN and social security number holders. The information is available to the public, as is the name, taxpayer number, date of birth, and social security number for the IRS records that we can use when preparing tax return transcripts. The information you provide here will aid in the identification of individuals who are ITIN and SSN holders and will assist us in developing a tax return transcript for the taxpayers in a timely manner. The IRS cannot guarantee that the information provided here regarding your ITIN and social security number will be accurate. However, if you provide us with a valid social security number, you will not need to provide proof or identity. Please be certain to review the information carefully and make your corrections only when necessary. For individuals and companies filing tax returns with the U.S. Department of Treasury. See the Instructions for Forms 4506T-EZ for forms for individuals and Forms 4506T-EZ for forms that are applicable to corporations. FOR USE WITH AN E-FILING PROGRAM.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Springfield Missouri Form 4506T-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a Springfield Missouri Form 4506T-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Springfield Missouri Form 4506T-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Springfield Missouri Form 4506T-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.