Award-winning PDF software

Form 4506T-EZ for Montgomery Maryland: What You Should Know

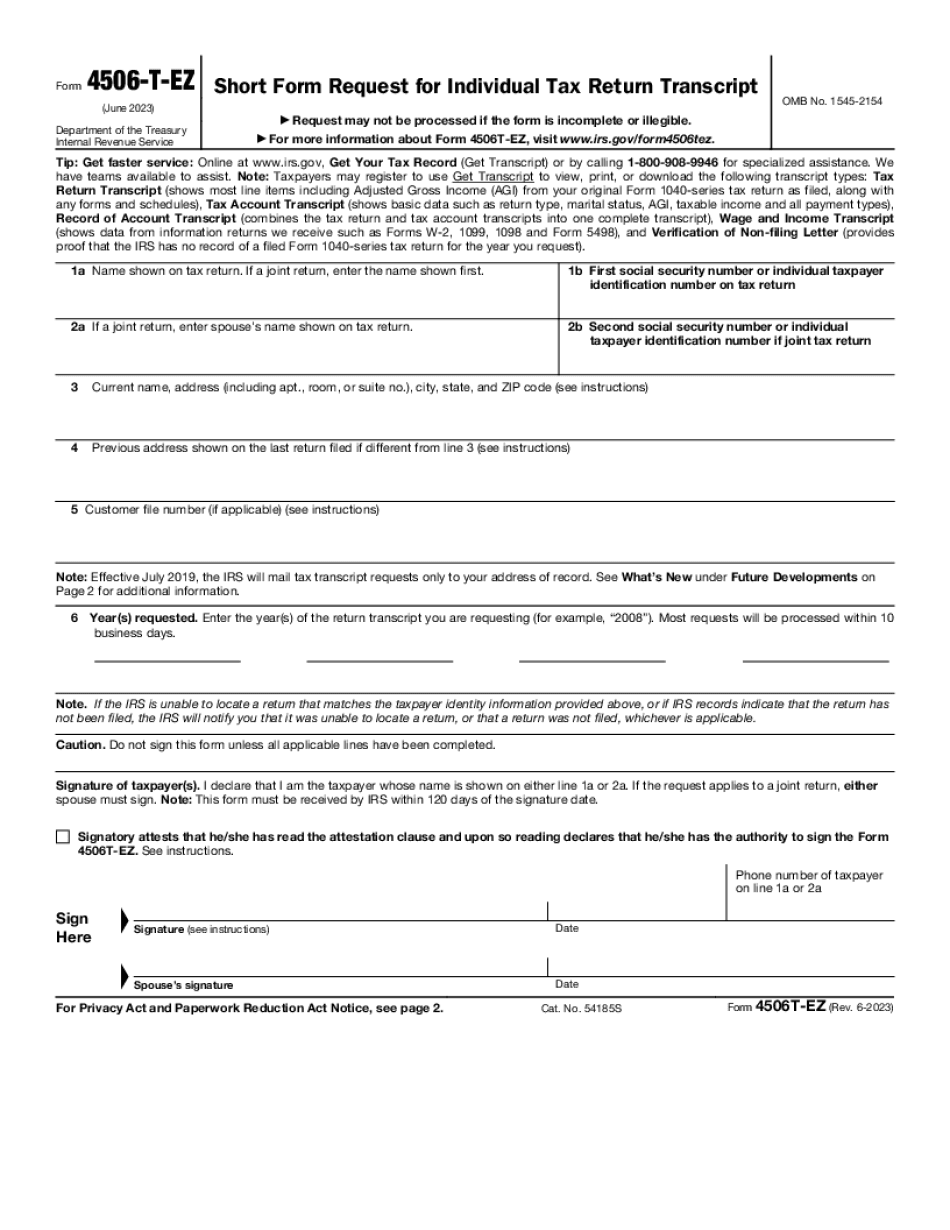

They must use it for their own audit purpose, and not for any other purpose. It must be preserved for 3 years to allow for audit log review. The IVES must provide the documentation to the Taxpayer. Form 4506-T: To be submitted by mail by the individual. To get an tin/EIN holder, go to EIN holder.gov or IVES Participant Retention of Documentation : The following must be retained by the individual: A. The actual completed Form 4506T, Form 4506-EZ or both. B. The return itself (as scanned or as an original or certified copy). C. A supporting copy of the W-2 form, showing all deductions. IVES Participants who file jointly must maintain 2 supporting copies, 1 for all returns. Form 4506EZ: Include as Part of the Tax Return the actual Form 4506T-EZ form and a copy of the W-2 form. IRS Electronic Signature Requirements The following electronic signature requirements must be met: The individual must: A. Complete Form 4506 in ink, complete the entire form with a check mark (X) at the beginning of the return or statement. B. Sign his or her name using two pen or ink fingerprints. If it is the case that the individual does not sign the return or statement as required, a statement of the nonsignatory must be attached to the return and must clearly explain the reason(s) why no signature was provided. The form shall include the identification number for the individual(s). Form 4506T: To be submitted by mail by the individual. To get an tin/EIN holder, go to EIN holder.gov or IVES Participant Retention of Tax Return: The following forms must be retained by the individual: W-2 for each year in which the return and/or document is to be filed. Form W-2 (with tax withheld) for each year which includes an amount to be withheld during the year from the payer's employee share of the social security/Medicare tax. VAT Returns: In addition to the following requirements, the individual must: A. Complete Form 5471 (or Form 5471A) for each year that an individual's business is conducted in the state. B.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ for Montgomery Maryland, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ for Montgomery Maryland?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ for Montgomery Maryland aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ for Montgomery Maryland from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.