Award-winning PDF software

Form 4506T-EZ for Salt Lake Utah: What You Should Know

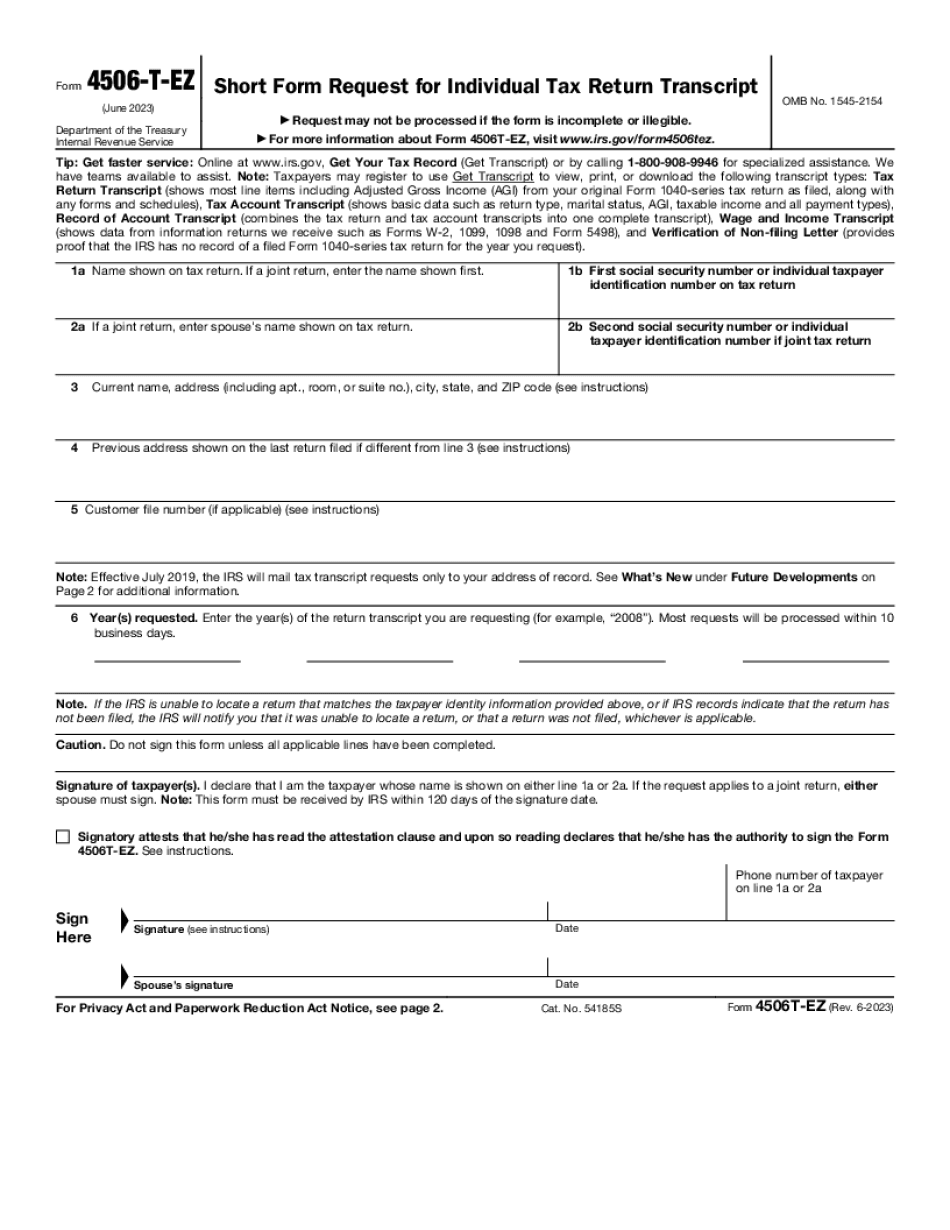

In order to preserve the Form 4506-T (Rev. 9-2018), the IVES must retain the following audit log information: All completed forms, records and related documentation, including originals, electronic copies and electronic versions. IVES Information Retention Form 4506-T-EZ (Rev. 9-2018) — IRS Include your name and any other details needed to identify your records in a folder. A complete backup of your records is mandatory. For more information, call the VAR at. VAR Information Retention Form 4506-T-EZ (Rev. 9-2018) — IRS This form is used when the audit report can be produced electronically. This should be used if the audit report cannot be produced electronically, and the agency determines that the document or documents that are required in the audit log cannot be located (for example, your Form 4506-T is too large to be reproduced or if there was a loss of materials in the office). IVES Information Retention Form 4506T-EZ (Rev. 9-2018) — IRS Your account number (or Form 4506-T-EZ number) is also required or provided if you did not provide it on your original form, but in the report, you are asked to provide this number. VAR Information Retention Form 4506T-EZ (Rev. 9-2018) — IRS VAR provides verification and verification of the accuracy of the information in your account(s). All information submitted to the VAR will become part of the audit report as shown on I-9. If you want to ask any questions about this form, or you are not sure what to submit, contact one of our auditors. IOWA: IOWA TAXPAYER INFORMATION SYSTEM (ITIS) Form 4506T-EZ The Iowa Income Taxpayer Information System (ITIS) uses a secure and automated technology system to electronically transmit tax information to the office of the Iowa Secretary of State for use in filing and assessment of Iowa income tax returns. The system operates 24 hours a day to provide an accurate account of tax account information and tax liabilities. The information from the electronic system is used to calculate your due dates for tax returns as well as penalties for unpaid taxes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ for Salt Lake Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ for Salt Lake Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ for Salt Lake Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ for Salt Lake Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.