Award-winning PDF software

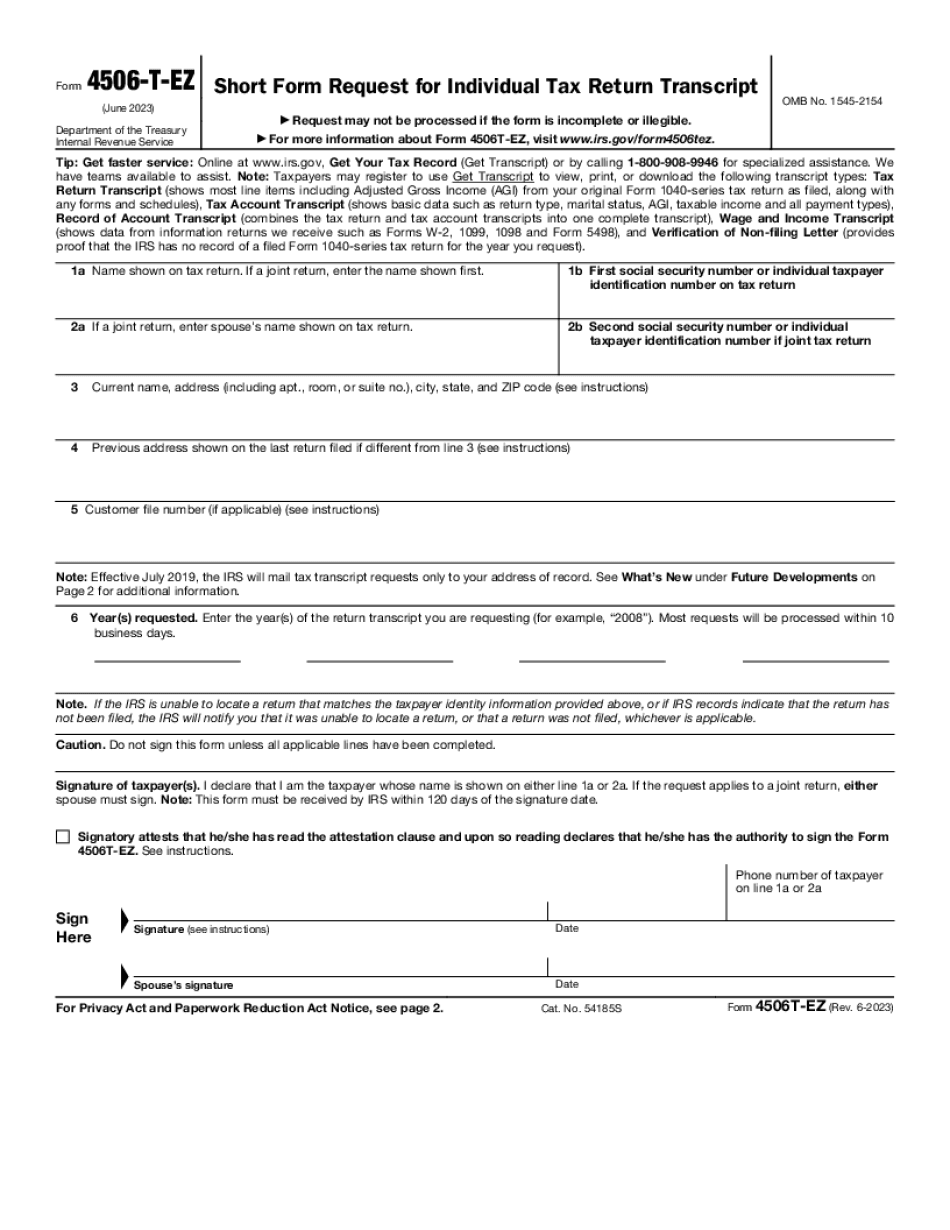

Form 4506T-EZ Illinois: What You Should Know

They can If a taxpayer completes it within 30 days of a tax deadline, the IRS must provide the information within 8 weeks of that deadline (30 days by 10/25/18, 35 days by 10/23/18, 40 days by 10/16/18, 45 days by 10/9/18). This does not apply to filing extensions. (See page 12.) If a taxpayer completes it after the specified deadline but before 8 weeks of the tax anniversary date, then the IRS must provide the information within 8 weeks of the tax anniversary date. (See pages 1213.) If a taxpayer completes it after August 16, 2022, the IRS must provide the information within 8 weeks of that date. (See page 13.) The form provides a customer the following: 1) Whether they have filed a previous or subsequent tax return (if yes, the extension applies); 2) the date of the most recent return (or the date they filed if they have filed a return); 3) the filing status of the return (single, married filing jointly, joint); 4) the filing status of the return and the corresponding tax year (e.g., married filing separate, married filing common-law); 5) information about the taxpayer's business activity, such as total sales and use in a specific activity; 6) information about the taxpayer's charitable contributions; and 7) the taxpayer's total estimated tax obligations (TOTAL) for the business activity. (See FAQs 10-12). If the taxpayer is claiming a refund or credited against an outstanding tax, tax refund or credit, the service cannot consider the information provided for that reason for TOTAL. (See FAQs 14-16). The service cannot rely on the service provider's interpretation of the information and cannot determine the accuracy or completeness of the returned information. (See FAQs 17-19). If the taxpayer has filed for a hardship exemption or other tax exemption, the taxpayer's request for the information may be refused. A taxpayer can use Form 4506-T to request the information only once, even if the taxpayer refiled the same return. (See FAQ 24) See page 29 for the customer's address for tax account information. OMB No. . OMB No. . OMB No. . OMB No. .

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ Illinois, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ Illinois?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ Illinois aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ Illinois from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.