Award-winning PDF software

Form 4506T-EZ Minnesota: What You Should Know

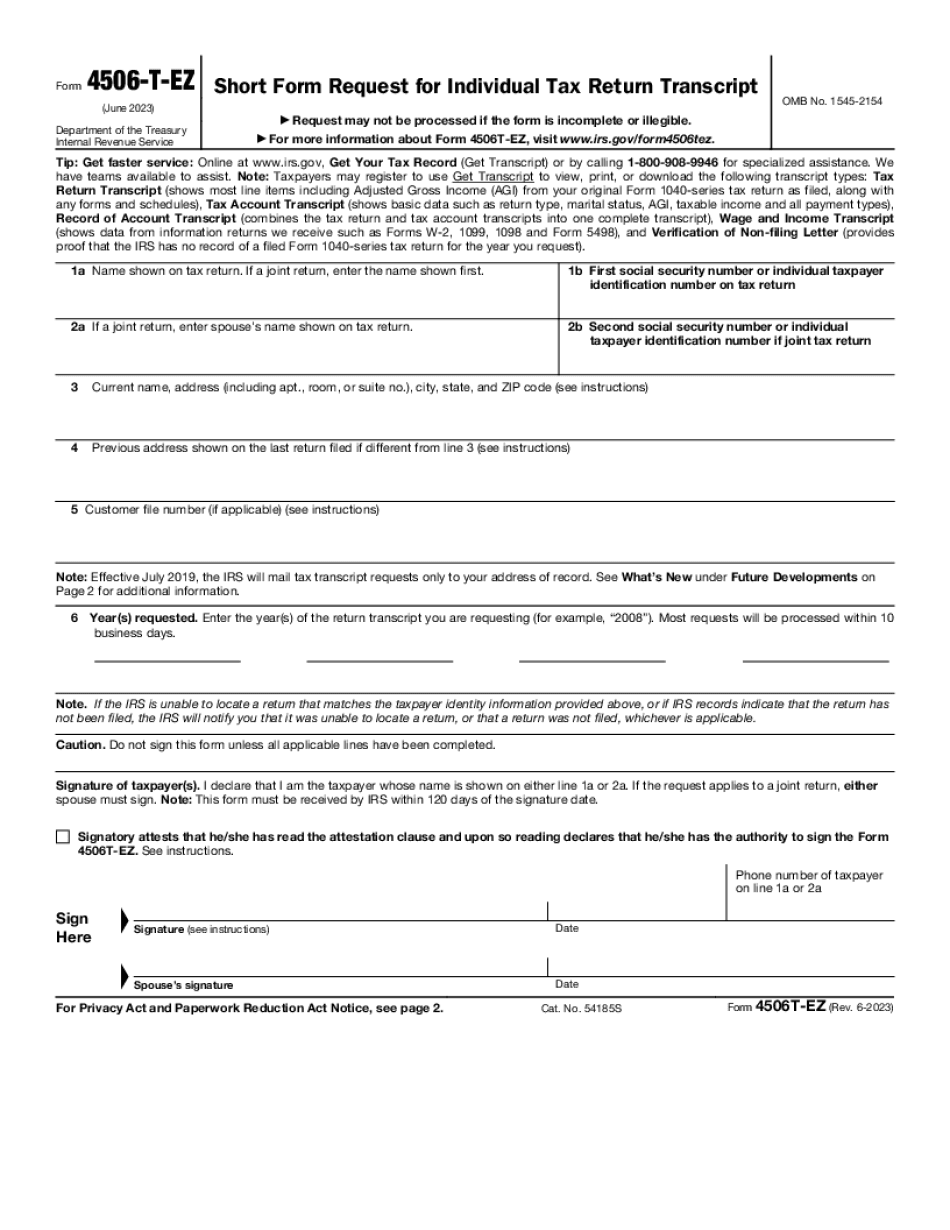

Form 4506-T-EZ, or Form 4806. Comment is requested regarding Form 4506-T or Form 4806. (See Part I, Item 4) Form 4506-T Request for Transcript of Individual Tax Return Form 4506-T requires: Received a written request for a transcript from the IRS. A tax return transcript (Form 4506-T) must be obtained if any item of information does not match IRS records. A new copy or a new copy that has not previously been made of the item of information should be obtained. The type of copy requested will depend upon the information provided by the individual. If a new copy is requested, it should be: A physical copy to ensure confidentiality of the records; and A copy that clearly depicts the information in the form, including the form, the signature and dates it is filed or the information reported. (See page 37.) A new copy is not necessarily required if: The person in question provided the information through an Internet Website and the information is: An electronic tax return record that is transmitted to the IRS through an Internet Website; or Data that is transmitted in response to a query by the IRS; provided that the form contains no information relating to an application made or a return filed that is reported to the IRS through an online service. (See IRS guidance). In situations in which the taxpayer's signature has been added, the copy should also be sent to the IRS address noted in box 8, which identifies the taxpayer or taxpayers who filed the original return. (See paragraph 28.) To obtain a written request through a Website. The information must be: Transmitted at a high speed which can be downloaded and stored on the Internet. If transmitting electronic returns it must not exceed 120 kilobytes a second. Transmitted through a computerized system or application in which the information is received by a user rather than the IRS system; A telephone line must be established to obtain the requested information. A signed authorization must be signed or otherwise attached which includes the person receiving the information stating the following: Whether the person is an individual or a business. Whether he or she is the person entitled to request the electronic returns; A business entity such as a corporation must have a signed authorization showing that it is authorized to request (See paragraph 29.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4506T-EZ Minnesota, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4506T-EZ Minnesota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4506T-EZ Minnesota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4506T-EZ Minnesota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.