Music there are different ways to obtain tax return information. Most requests can be satisfied with a computer printout of your return information called a transcript. However, sometimes you need an exact copy of a previously filed and processed tax return with all attachments, including form W-2 copies. Generally, form W-2 copies are available for returns filed for the current and past six years on jointly filed tax returns. Either spouse may request a copy and only the signature from the requesting spouse is required on the form 4506 request for copy of tax return. You should complete form 4506 and mail it to the address listed in the instructions along with a $50 fee for each tax return requested. Make your check or money order payable to the United States Treasury. Enter your Social Security number in or an and form 4506 request on your check or money order. Allow 75 calendar days for us to process your request. If you're a taxpayer impacted by a federally declared disaster, the IRS waives the usual fees and expedites requests for copies of tax returns for people who need them to apply for benefits or to file amended returns claiming disaster related losses. To request a copy of a fraudulent tax return, use form 4506 F. The IRS also offers various transcript types free of charge. US Citizenship and Immigration Services and lending agencies for student loans and mortgages generally accept a tax return transcript as a substitute for a copy of your return. You can go to the get transcript page to request your transcript now. You can also order tax return and account transcripts by calling red nine zero eight nine four six and following the prompts in the recorded message or by completing form 4560 request for transcript of...

Award-winning PDF software

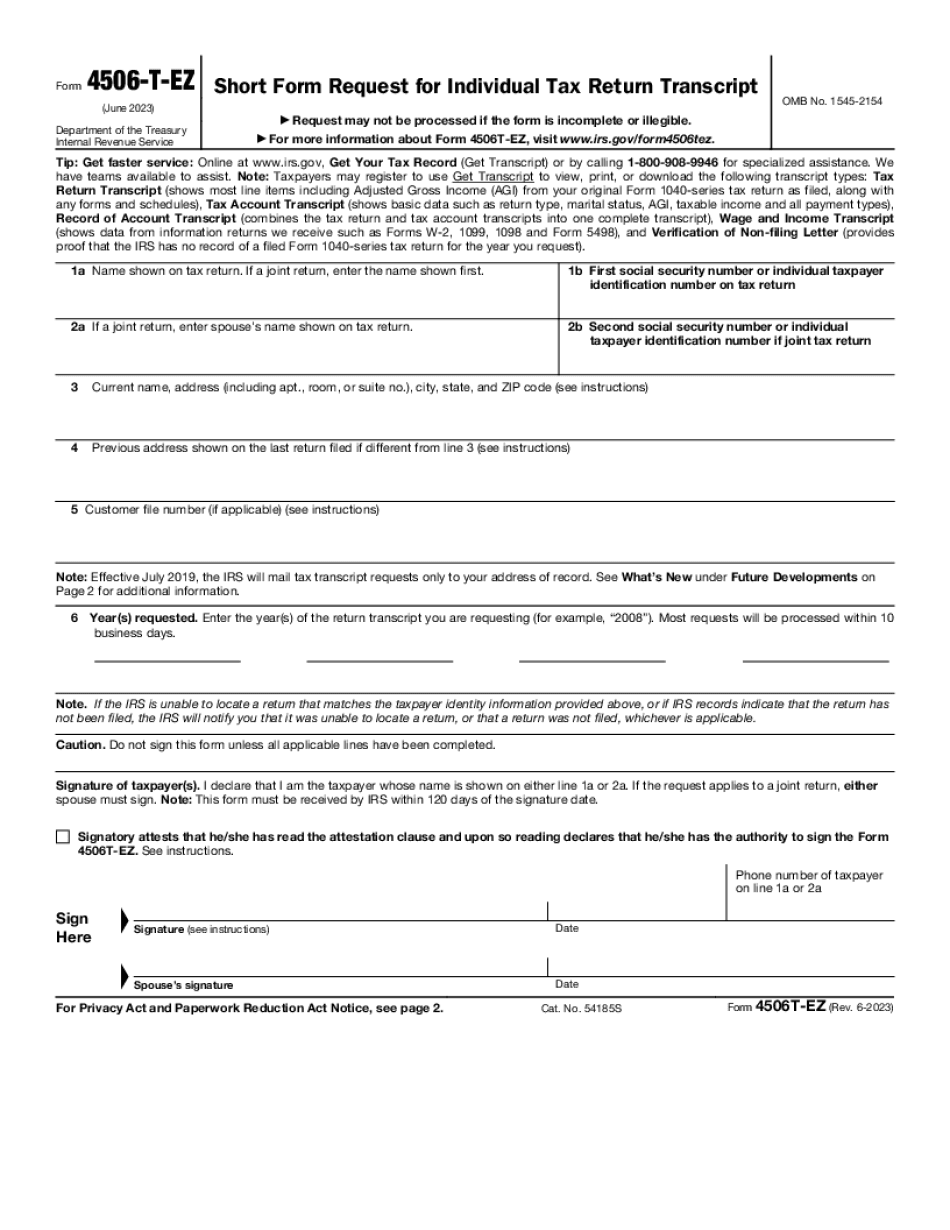

How to prepare Form 4506T-EZ

What Is How To Fill Out 4506 T Form?

Online solutions assist you to arrange your file management and increase the productivity of your workflow. Look through the short guide to be able to fill out IRS How To Fill Out 4506 T Form, stay clear of mistakes and furnish it in a timely manner:

How to complete a 4506t Ez Form Printable?

-

On the website with the document, click on Start Now and pass towards the editor.

-

Use the clues to complete the suitable fields.

-

Include your individual data and contact data.

-

Make certain you enter correct details and numbers in proper fields.

-

Carefully review the data of your form as well as grammar and spelling.

-

Refer to Help section when you have any issues or contact our Support team.

-

Put an electronic signature on your How To Fill Out 4506 T Form printable with the assistance of Sign Tool.

-

Once the form is finished, click Done.

-

Distribute the ready through electronic mail or fax, print it out or download on your gadget.

PDF editor permits you to make changes to the How To Fill Out 4506 T Form Fill Online from any internet linked gadget, customize it in accordance with your requirements, sign it electronically and distribute in several approaches.

What people say about us

Filing electronically forms from your home - crucial tips

Video instructions and help with filling out and completing Form 4506T-EZ