Award-winning PDF software

Waco Texas online Form 4506T-EZ: What You Should Know

Form 4506-C, completed and signed by Applicant. All applicants for IRS 501(c)3 exemption must submit Form 4506-A. If you receive a denial notice, you need to follow the steps below to challenge the denial. You must also file a protest with the IRS. Prove Your Exemption in Court If you were denied, the best way to challenge your denial is to take the necessary steps to prove your exemption in court. Your challenge will be stronger if you challenge the IRS in court. Your proof must establish three things: That you formed your organization's purpose in accordance with its governing laws (including applicable state tax laws), and have applied to use the exempt function of your organization as a tax-exempt function. That your organization (or group of individuals) meets the IRS 501(c)3 and the applicable IRS guidelines. If your organization does not meet the requirements, the IRS may take one of the following actions to investigate your compliance or may revoke your exemption: Appeal and Receive an Approval from the IRS The first step to proving your eligibility requires: Pay the IRS the fee it levied — 75. For a complete list of the tax imposed, see IRS Form 4970 (Form 429) on IRS.gov. Send the payment to Internal Revenue Service You must wait at least 30 days from the date you received your denial notice before you file an administrative appeal with the IRS. If any of the following occur within that time period, your appeal will be denied, and you will receive a letter advising of the outcome: You file a protest with the IRS. You file a motion in small claims court. You file a petition for reconsideration. The denial notice is served on you personally, if you have not already submitted it to the IRS. If your challenge is decided in your favor, you are required to pay all tax costs incurred. If your challenge is not heard, or you do not meet the requirements of section 5 of the Exempt Organizations Statute, you will have to register as nonprofit (see IRS Publication 559). Replace Your Mailing Address You should keep the denial notice and the Taxpayer ID number you received from the IRS. Contact your tax preparer if you want to obtain a new Taxpayer ID number.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Waco Texas online Form 4506T-EZ, keep away from glitches and furnish it inside a timely method:

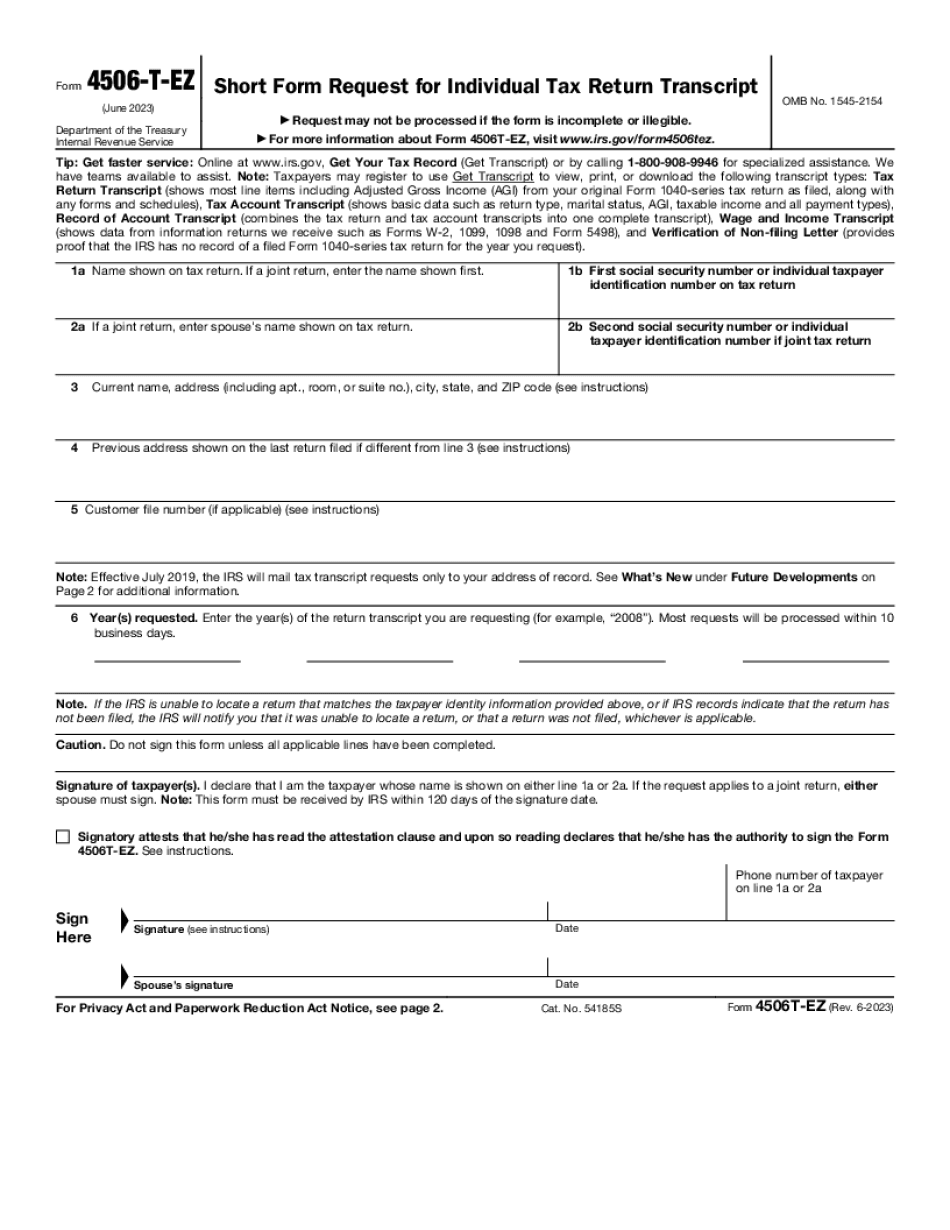

How to complete a Waco Texas online Form 4506T-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Waco Texas online Form 4506T-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Waco Texas online Form 4506T-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.