Award-winning PDF software

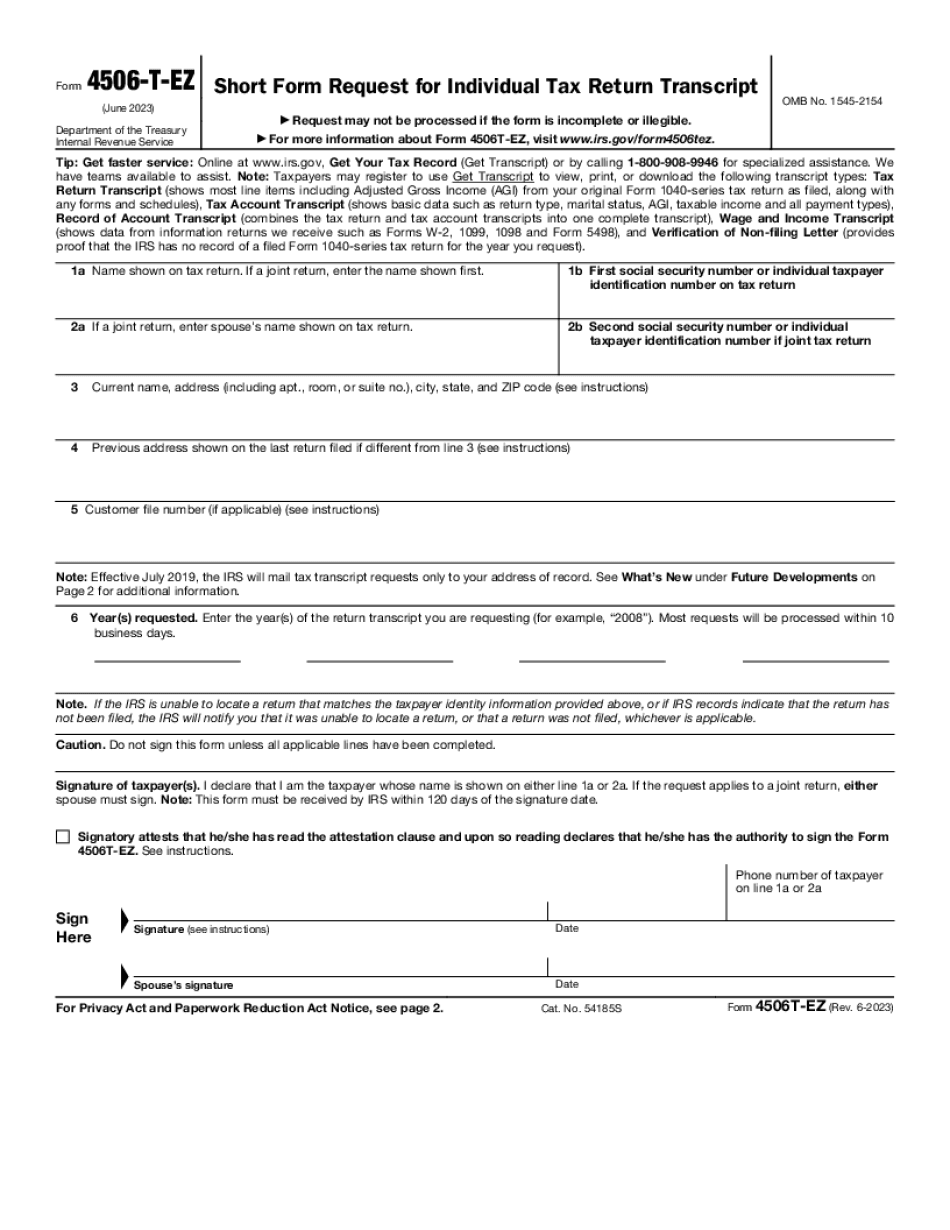

MT online Form 4506T-EZ: What You Should Know

Choose “Get Your Transcript of Tax Return, select a tax year, ․ and submit your request. • Submit by mail or fax.• Mail: IRS Tax Transcript Fax: (e-mail) If one of the following situations applies: • You are not an individual (but you are a parent or child) • You are not a student or parent • You are a small business. Email MCC † or call. What is a COVID-19 (COVET)—Tax Credit for Disasters? The COVID-19 (COVET) is a tax credit program that promotes emergency relief for families and communities in the U.S. that have been hard-hit by natural disasters. Under the COVID-19 program, local governments may offer a tax credit to individuals impacted by natural disasters that exceed a 6,500 limit. The IRS administers the COVID-19 program, and grants a limited number of credit claims each year by local governments. For more information about this program, go to . How to apply for the Credit? • Get a copy of Form 4506 (or 4506T) from the local government. • Print, complete and submit the form. The IRS may deny a claim for the credit. You can appeal to the IRS Appeals Center, located outside U.S. Tax Court, at IRS. Appeals. Is there an annual limit for the credit? • The COVID-19 program includes only individual claims. • If the cost of a family member's relief is less than 6,500 for the taxable year, the family may claim their own credit. The family cannot claim a portion of your credit if they already paid the tax that was the basis for the credit. Do not file a claim for a COVID-19 credit if the credit would cost you more than the 6,500 limit. Citizens may also qualify for other emergency relief programs, such as financial relief for storm or earthquake victims. Find more information at: , The Emergency Relief Network or the State and local government relief programs in the District of Columbia and FEMA. To get a copy of the tax record, go to: IRS.gov/taxpayer/resources/tax-records/pdf/tax‐record-pdf.pdf.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MT online Form 4506T-EZ, keep away from glitches and furnish it inside a timely method:

How to complete a MT online Form 4506T-EZ?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MT online Form 4506T-EZ aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MT online Form 4506T-EZ from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.